Best Fintech Application Development for Faster Digital Payments

The global financial ecosystem is rapidly transforming as digital payments become the preferred mode of transaction for individuals and businesses alike. Speed, convenience, and security have become the top priorities for users, prompting organizations to invest in advanced fintech applications. Today, faster digital payments are not just an advantage—they are a necessity. Whether it’s instant UPI transfers, real-time settlements, mobile wallets, or cross-border payments, users expect lightning-fast processing without any errors or delays.

This shift has created a massive demand for fintech apps that deliver efficiency, stability, and next-level digital experience. To achieve this, businesses need the expertise of a trusted fintech app development company that understands the complexity of financial infrastructure and knows how to build scalable systems designed for speed.

Why Faster Digital Payments Matter Today

The way people handle money has changed dramatically. Long bank queues and traditional paperwork have been replaced with instant and contactless digital transactions. Businesses now rely on automatic payment systems to operate smoothly, while consumers expect immediate confirmations for every transfer.

Here’s why fast digital payments are essential:

1. Enhanced Customer Satisfaction

Speed directly impacts customer experience. When a transaction completes in seconds, trust and convenience increase significantly.

2. Business Competitiveness

Brands offering instant payments gain a massive competitive advantage, especially in eCommerce, fintech, and retail sectors.

3. Real-Time Financial Management

Instant payment data helps businesses manage cash flow, generate real-time reports, and streamline accounting.

4. Reduced Operational Bottlenecks

Automated systems eliminate errors and delays associated with manual transactions.

5. Secure and Reliable Processing

Modern fintech solutions combine speed with robust security protocols to ensure protected transactions.

Key Features of Fast and Efficient Digital Payment Apps

To deliver quick transactions, fintech apps must include advanced features such as:

1. Real-Time Processing Engine

A powerful backend engine ensures instant settlements for domestic and international transactions.

2. API-Based Payment Integrations

Seamless integration with payment gateways, banks, wallets, UPI, and third-party financial services.

3. Cloud-Based Infrastructure

Cloud architecture supports high-speed transactions and scalability during peak loads.

4. Modern Authentication Systems

Biometric login, multi-factor authentication (MFA), and encryption secure data while maintaining user-friendly speed.

5. Smart Transaction Routing

Intelligent routing algorithms choose the fastest available payment path.

6. Automated Fraud Detection

AI and ML analyze transaction behavior in milliseconds to identify suspicious activities.

7. Offline Payment Support

Allows users to initiate payments even with weak or no internet, processing them instantly once connectivity returns.

Types of Fintech Apps Designed for Faster Digital Payments

A professional provider offering advanced fintech app development services builds several types of solutions focused on speed and efficiency:

1. UPI and Instant Payment Apps

These applications support real-time fund transfers, bill payments, and peer-to-peer transactions.

2. Mobile Wallet Applications

Wallets allow users to make quick payments without repeatedly entering card details.

3. Contactless Payment Systems

NFC-enabled apps make tap-and-pay transactions faster and seamless.

4. Merchant Payment Apps

Retailers use these apps for instant settlements, POS integration, and QR-based payments.

5. Cross-Border Payment Platforms

Fast currency conversion and international transfers with minimal delays.

6. Subscription & Recurring Payment Applications

Automated recurring charges ensure faster monthly billing.

7. Digital Banking and Neobank Apps

Modern digital banks provide instant onboard processing and instant payment transfers.

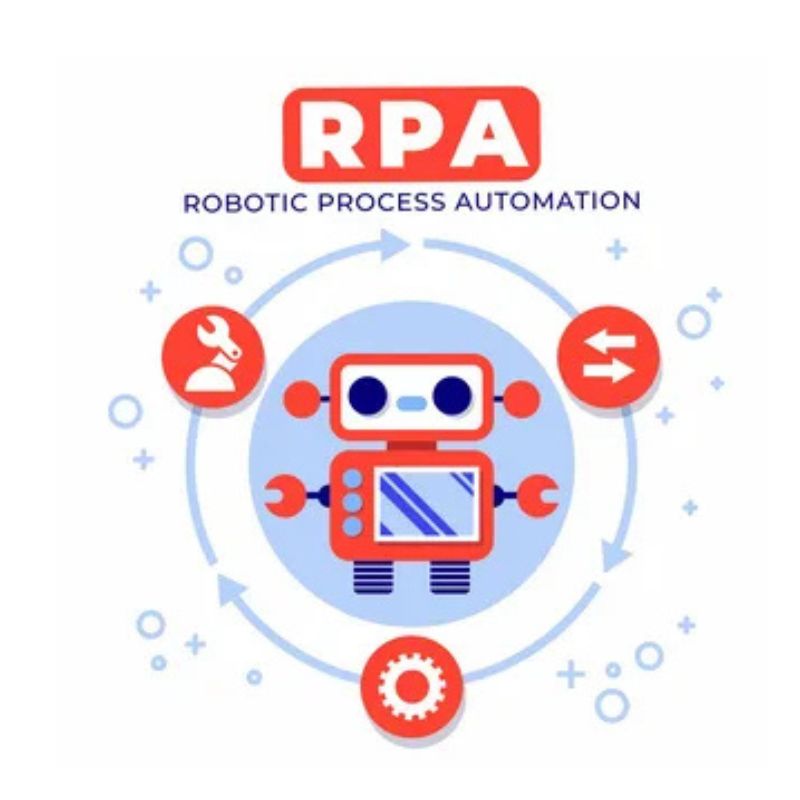

Technologies Driving Faster Digital Payments

Modern fintech applications use a blend of emerging technologies to ensure speed and reliability:

1. Blockchain Technology

Blockchain enables tamper-proof, real-time settlements with enhanced transparency.

2. Artificial Intelligence & Machine Learning

AI optimizes transaction flow, monitors user behavior, and speeds up validation processes.

3. Cloud Computing

High-speed cloud hosting ensures smooth performance during high-volume transactions.

4. Payment APIs and SDKs

Pre-built payment APIs reduce development time and improve processing speed.

5. Biometric Security Systems

Fingerprint, face recognition, and voice verification simplify authentication, making payments faster.

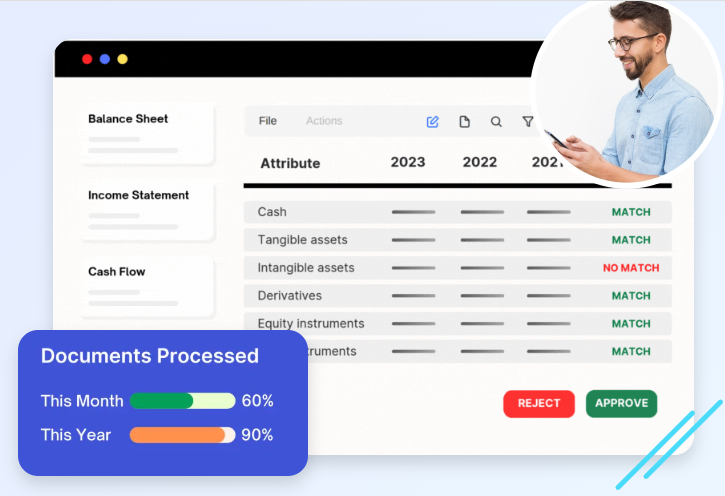

6. Big Data Analytics

Analyzes massive financial datasets in real time for instant approval or rejection.

Industries Benefiting from Fast Digital Payment Solutions

Faster payments are reshaping multiple sectors:

- E-commerce & Retail

- Banking and Finance

- Logistics & Transportation

- Travel and Hospitality

- Healthcare & Insurance

- Education & Online Learning

- Real Estate

- Food Delivery & On-Demand Services

Each of these industries benefits from secure instant payment capabilities that enhance customer experience and streamline business operations.

Benefits of Fast Digital Payment App Development

Working with an experienced fintech application development company helps businesses gain the following advantages:

1. Increased Customer Loyalty

Faster transactions encourage users to return for repeated purchases.

2. Higher Sales Conversion Rates

Quick payments reduce cart abandonment in online businesses.

3. Improved Operational Efficiency

Automation reduces manual tasks, enabling faster business operations.

4. Better Revenue Insights

Instant transaction records help businesses analyze financial performance in real time.

5. Reduced Costs

Automated payments reduce human error and operational expenses.

6. Enhanced Security

Use of encryption, tokenization, and biometric authentication ensures data protection.

Fintech App Development Process for Fast Digital Payments

A well-structured development process ensures stable and high-performing fintech applications:

1. Requirement & Research

Understand your target audience, business goals, and required features.

2. UX/UI Design

Create intuitive interfaces for quicker user navigation.

3. Payment System Architecture

Build secure, scalable architecture with fast transaction capabilities.

4. Backend Development

Develop the real-time transaction engine and integrate APIs.

5. Security Implementation

Add encryption, firewalls, MFA, KYC verification, and compliance layers.

6. Payment Gateway Integration

Connect multiple gateways and third-party financial platforms.

7. Testing & Quality Analysis

Test app speed, security, performance, and reliability.

8. Deployment & Post-Launch Support

Deploy the app and provide continuous updates, monitoring, and improvements.

Why Partnering with an Expert Fintech Team Matters

Building fast, secure, and reliable digital payment apps requires:

- Expertise in financial infrastructure

- Deep understanding of regulatory compliance

- Mastery of payment gateways and APIs

- Experience in security protocols

- Strong backend architectural skills

Choosing the right development partner ensures seamless, secure, and rapid transactions across all platforms.

Conclusion

The rise of digital payments has created an urgent need for fast, efficient, and highly secure fintech applications. Businesses that fail to adopt modern payment technology risk losing customers to competitors that offer instant digital experiences.

By partnering with the right fintech experts, organizations can build advanced applications that deliver lightning-fast payments while maintaining the highest security standards. With innovations in AI, blockchain, cloud computing, and biometric authentication, the future of digital payments is faster and safer than ever.

FAQ: Best Fintech Application Development for Faster Digital Payments

1. What makes a fintech app fast and reliable?

A combination of optimized server architecture, cloud computing, real-time APIs, and smart routing enables faster payment processing.

2. How secure are fast digital payment apps?

They use encryption, tokenization, MFA, and continuous fraud monitoring to maintain top-level security.

3. Can fintech apps handle global payments?

Yes, they support multi-currency, cross-border transfers with real-time conversions.

4. How long does it take to develop a fintech payment app?

Typically 3 to 6 months depending on complexity, features, and integrations.

5. What industries need fast digital payment systems the most?

E-commerce, retail, finance, healthcare, travel, and education rely heavily on instant payment capabilities.

6. Do these apps support multiple payment modes?

Yes—UPI, credit/debit cards, mobile wallets, QR codes, online banking, and POS integrations.

7. What technologies improve payment speed?

Cloud infrastructure, APIs, blockchain, AI/ML, and real-time data processing tools.

English

English