Add Advanced file upload for WooCommerce Features to

Nov 20, 2025Use hide out of stock products woocommerce for

Nov 20, 2025What Makes Wireless EMS Suits the Future of

Nov 20, 2025Why London Mobile App Developers Are in High

Nov 20, 2025CCTV for Schools in Lahore – Enhancing Safety

Nov 20, 2025Top 3 YouTube Downloaders With No Ads or

Nov 20, 2025Transform Your Home with Luxury Kitchen Cabinets for

Nov 20, 2025Boost Your Property Business with SEO for Real

Nov 20, 2025Affordable AC Duct Cleaning in Dubai – Ensuring

Nov 20, 2025Car Recovery Motor City Dubai | Fast &

Nov 20, 2025Easy Guide: Product Gallery Slider for WooCommerce

Nov 20, 2025Premium Packaging Solutions with Soap Boxes

Nov 20, 2025How Real-Time Data Improves Financial Reconciliation

Nov 20, 2025Labubu Doll usa : A Playful Blend of

Nov 20, 2025Understanding Amp Effects: From Gain to Reverb Magic

Nov 20, 2025Why Hire a Digital Marketing Company India for

Nov 20, 20255 Mistakes Canadians Make When Changing CAD to

Nov 20, 2025Hair Transplant in Dubai: Cost and Factors Explained

Nov 20, 2025Benefits of Hiring a Licensed and Insured Commercial

Nov 20, 2025How to Get Started With Jarvis Reach: Step-by-Step

Nov 20, 2025How to Achieve Continuous Quality with Open Source

Nov 20, 2025The Madina Online Quran Academy Experience

Nov 19, 2025TPPlay: A Modern Platform Built for Ease

Nov 19, 2025Top Building Contractors in Chennai

Nov 18, 20258 Pasta Types: From Classics to Unique Picks

Nov 18, 2025Why Consumers Prefer the Best Natural Skin Care

Nov 18, 2025Top Scalp Oil Secrets The Key to Healthy

Nov 18, 2025Transform Your Ideas with a Trusted React JS

Nov 17, 2025Food Truck for Sale Adelaide – Affordable Mobile

Nov 17, 2025Buy Diamond Nose Pin Online | siriusjewels

Nov 17, 2025Winning the Scale Game: Automated CRM for Modern

Nov 17, 2025How to Download and print Udyam Certificate

Nov 17, 2025Your Complete Guide to Stylish 18K Gold Pendant

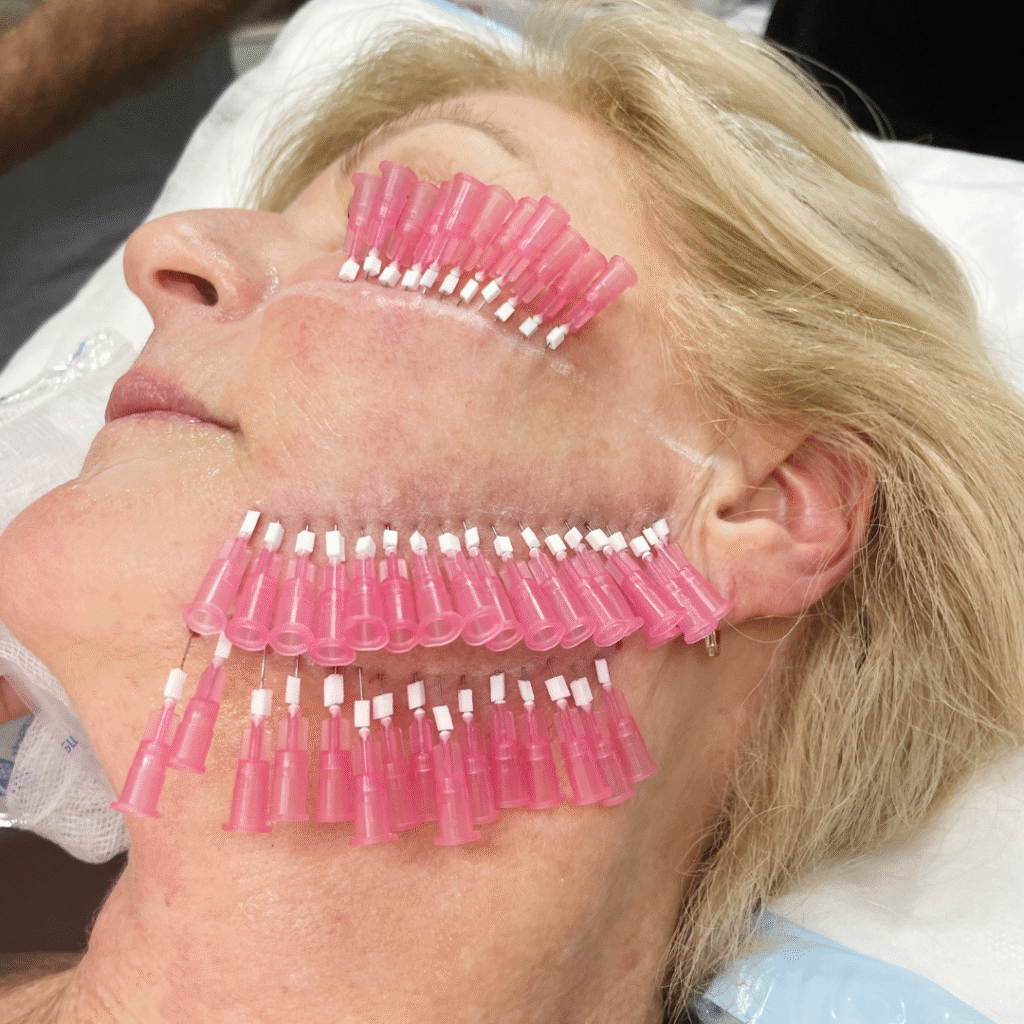

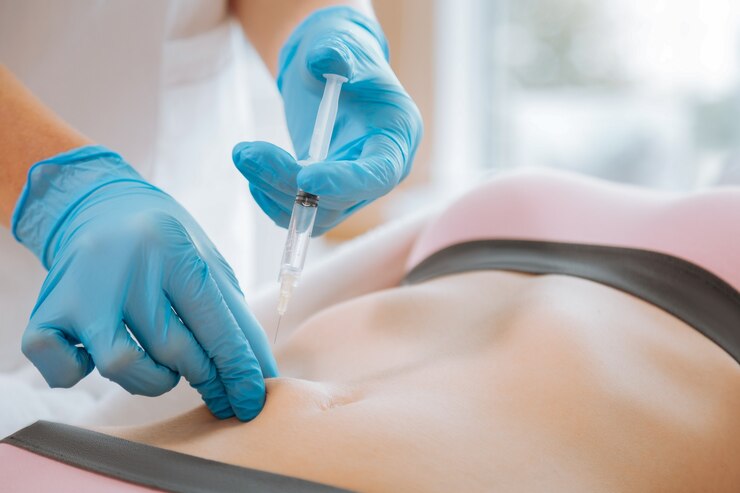

Nov 17, 2025Plastic Surgery Nurse After Care

Nov 15, 2025Air Ticketing Course in Rawalpindi

Nov 15, 2025Acrylic Photo Frame: Stylish and Durable Way to

Nov 14, 2025Where Can You Find the Best brown leather

Nov 14, 2025Top Comfort & Security to Choosing the Perfect

Nov 13, 2025Birla Pravaah Sector 71 Gurgaon – Redefining Luxury

Nov 13, 2025Why Custom Cups Are Essential for Food Delivery

Nov 13, 2025Company Directors: How to Legally Claim Medical &

Nov 13, 2025Upgrade Your Pool Routine With a Smarter Extension

Nov 13, 2025The Hidden Home Check That Saves You Thousands

Nov 13, 2025How to Select a Quality Silver Kiddush Cup

Nov 13, 2025How Businesses Will Use Managed SEO to Drive

Nov 13, 2025Building a Future-Ready Business with IT Solutions

Nov 12, 2025The Role of Helical Worm Gearboxes in Steel

Nov 12, 2025Managing Chronic Diseases with Dr Virendra Kumar

Nov 12, 2025Where to Buy Korean Barrier Repair Moisturiser in

Nov 12, 20255 Common Local SEO Mistakes (And How to

Nov 12, 2025Standard vs Custom Backdrops: Which Makes a Bigger

Nov 12, 2025Comparing Pivot Arm Awnings and Fold Out Shade

Nov 12, 2025Experience the Thrill of Ice Fishing Levi and

Nov 11, 2025Top AI Cover Letter Tools for Smarter Job

Nov 11, 2025Custom 3D Puff Embroidery Digitizing

Nov 11, 2025SalesEcho and the Rise of AI-Powered Sales Call

Nov 11, 2025Vaporesso XROS 5 Mini Pod Kit Review

Nov 10, 2025How Long Should Your Blog Articles Be?

Nov 10, 2025Nutella Spread: The Perfect Jar for Families &

Nov 10, 2025CAD to USD – Timing the Market for

Nov 10, 2025EB1 Requirements Explained – Qualify for Your EB1

Nov 08, 2025The Best TikTok Video Download Tools for 2025:

Nov 08, 2025Custom Die Cuts Boxes: The Ultimate Guide to

Nov 07, 2025Comparing Old City vs. Modern Living in Jerusalem

Nov 07, 2025Fire Guard Services in the USA | Protect

Nov 07, 2025Benefits of Hiring Licensed Security Guards in Los

Nov 06, 2025The Hidden Power of Local Backlinks for SEO

Nov 06, 2025MP3Juice vs. YTMP3: Which MP3 Downloader Wins?

Nov 06, 2025Rising Importance of Industrial Packaging in Chennai

Nov 06, 2025Rx Propellant’s 9 Lakh Sq. Ft. Lab Spaces

Nov 06, 2025How Private Security Prevents Crime in Urban Cities

Nov 05, 2025What Causes Bleeding Gums and How to Stop

Nov 05, 2025PowerPoint Template Guide for Stunning Presentations

Nov 05, 2025How Online Reviews Can Boost Your Brand Credibility

Nov 05, 2025Types of Banner Printing and Their Best Uses

Nov 05, 2025Birthday eCards for Him: The Perfect Way to

Nov 05, 2025Transform Your Bathroom with Perth Shower Screens &

Nov 04, 2025CMDA Approved Plots: What Chennai Buyers Should Know

Nov 04, 2025Key Traits of a Great Seasonal Agricultural Labor

Nov 04, 2025Power Creative Web Design Dubai with RedSpider Web

Nov 04, 2025Geek Bar Vape: A Deep Dive into Voyoria

Nov 03, 2025Elevate Your Brand with Expert Brand Logo Designing

Nov 03, 2025Denim Tears’ Approach to Sustainability

Nov 02, 2025Chrome Hearts Leather Goods Review

Nov 02, 2025Bold Logo Essentials Hoodies

Nov 02, 2025Everything You Need to Know About Online B.Com

Nov 01, 2025Why is ISI Mark Registration Mandatory for All

Oct 31, 2025What is Medical Summarization and Why Is It

Oct 31, 2025How to Choose the Best Video Editor for

Oct 30, 2025What You Should Know Before Getting a Prosthetic

Oct 30, 2025The Mental Health Toll of Academic Deadlines and

Oct 30, 202512 Creative Employee Christmas Gifts to Mark a

Oct 30, 2025Pulsar RS200 On-Road Price and Features – Is

Oct 30, 2025Small Kitchen? Here’s why an OTG Oven is

Oct 30, 2025Kilobytes Technologies: Elevating Startups in Mumbai

Oct 30, 2025The Best Uses for Personalized Stickers in Your

Oct 30, 2025The No-Stress Way to Clean Jets in a

Oct 30, 2025Custom Pillow Boxes for Distinctive Retail and Gift

Oct 30, 2025How to Send Money from Canada to Germany

Oct 29, 2025The Ultimate Guide to Home Nursing Services in

Oct 29, 2025Why SEBI Keeps Tweaking Futures and Options Rules

Oct 28, 2025Discover Chrome Hearts Germany – Premium Fashion and

Oct 28, 2025Tubidy MP3 Download Guide for Music Lovers

Oct 28, 2025Best Countries to Retire for Canadian Citizens in

Oct 28, 2025Best Study Visa Consultants in Delhi

Oct 28, 2025New York App Development Company Crafting Innovative

Oct 27, 2025Nav Grah Yantra: Aligning Planets with Inner Balance

Oct 27, 2025Discover Bold Urban Style with the Iconic Spider

Oct 27, 2025Tummy Tuck vs. Non-Surgical Options: Which Is Right

Oct 27, 2025Top Auto Paint Trends Redefining Car Style in

Oct 26, 2025Godrej Sora: The Epitome of Modern Luxury in

Oct 26, 2025A Smarter Future with Solar Energy with Battery

Oct 25, 2025The benefits of custom aluminum signs

Oct 24, 2025Send Christmas Gifts to USA Online: Unleash Festive

Oct 24, 2025Top European Countries to Retire on a Budget

Oct 23, 2025How Do Agencies Track and Prove Results in

Oct 23, 2025Why You Should Never Try to Handle Bail

Oct 23, 2025Emergency Eye Care in Etobicoke: When to Act

Oct 22, 2025Elevate Your Packaging Game with Custom Kraft Paper

Oct 22, 2025How to Pass a 4-Point Home Inspection

Oct 21, 2025What Ways Does PMP Certification Enhance Your Test

Oct 19, 2025Best Indoor Activities for Toddlers in Northridge

Oct 19, 2025Explore Mental & Emotional Benefits of Listen to

Oct 18, 2025Why Every Hotel Needs a Hospitality PR Company

Oct 17, 2025Boost Your Sales with an Effective PR Product

Oct 17, 2025How Product Launch PR Can Skyrocket Your Brand

Oct 17, 2025How a SaaS PR Agency Can Accelerate Your

Oct 17, 2025Top PR Companies for Startups Driving Media Success

Oct 17, 2025How PR Agencies Help Startups Win Investor and

Oct 17, 2025Top PR Strategies Every AI Company Should Use

Oct 17, 2025How AI is Transforming the Future of Public

Oct 17, 2025Hire Security for Event: Ensure Safety, Control, and

Oct 17, 2025How Can Skin Boosters Improve Your Skin Health

Oct 16, 2025Hire a Virtual Assistant for Social Media and

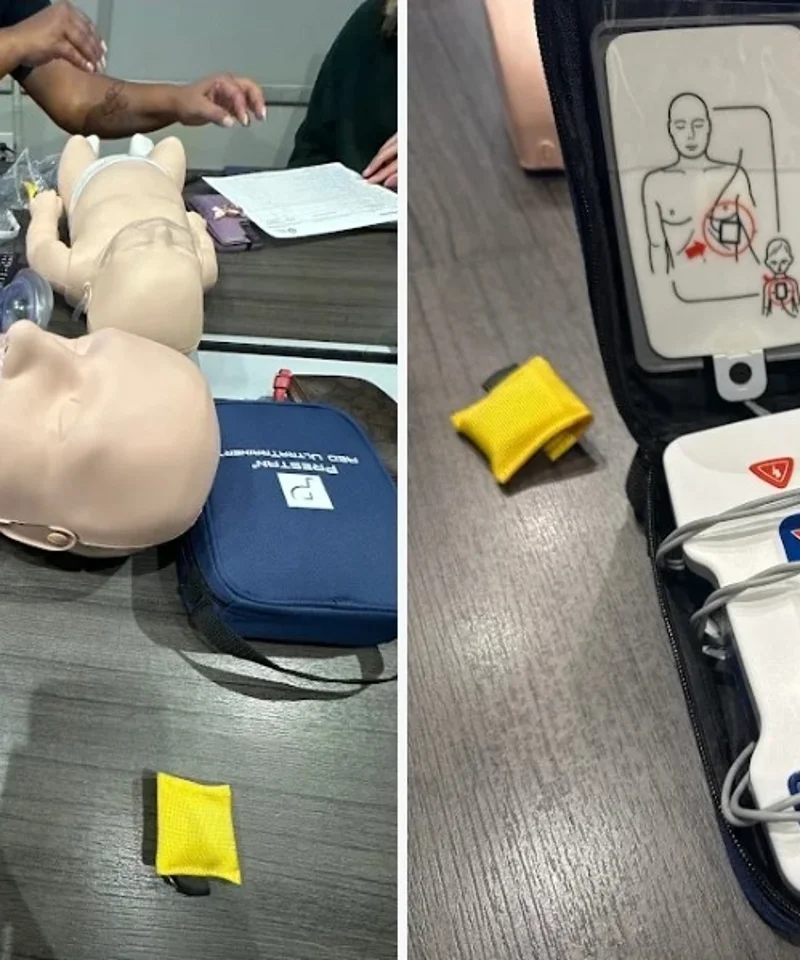

Oct 16, 2025How the AHA BLS Course Prepares You for

Oct 16, 2025How Can PPLI Life Insurance Transform Your Wealth

Oct 15, 2025Jobs in Dubai | Find Your Next Career

Oct 15, 2025Paying for Math Help vs. Paying Someone to

Oct 15, 2025How to Get the Best Score on Your

Oct 15, 2025Mobile App Development in Montreal: Trends and Best

Oct 15, 2025CPR Vs BLS: What’s the Difference and Which

Oct 15, 2025Cheap Property in Asturias Spain – Find Your

Oct 15, 2025YT5s: The Best Solution for High-Quality Video &

Oct 15, 2025A Complete Guide to the PADI Open Water

Oct 15, 2025Baby SIDS Monitor: Protecting Your Infant While You

Oct 14, 2025The Importance of Duct Cleaning in Laval for

Oct 14, 2025Lower Back Pain Treatment: When to See a

Oct 14, 2025Before You Call a Bondsman: 7 Common Bail

Oct 14, 2025Payroll Software in India Solves its Challenges

Oct 14, 2025Best Web Design in Canberra – Hungry Bull

Oct 13, 2025SATV Online Live – Watch Latest Bangla News

Oct 13, 2025Luxury Hotels in Sylhet – Experience Elegance at

Oct 13, 2025Limited Edition Chrome Hearts Releases

Oct 12, 2025Trends in Warehousing & Logistics Real Estate

Oct 11, 2025Moonstone Energy: A Crystal for Balance and Clarity

Oct 11, 2025How to Build a Profitable Baby Products Shop

Oct 11, 2025R and M Tornado 30000 box of 10

Oct 10, 2025Crystal Pro Max + 10000 Box of 10

Oct 10, 2025Hayati Pro Max Plus 6000 box of 5

Oct 10, 2025Hayati Pro Ultra plus 25000 box of 5

Oct 10, 2025Crystal Prime Pro 4500 box of 10

Oct 10, 2025Hayati pro Ultra 15000 box of 10

Oct 10, 2025Crystal Prime 7000 box of 10

Oct 10, 2025Enjoy Ultra 9000 Puffs box of 10

Oct 10, 2025R and M Tornado 15000 box of 10

Oct 10, 2025R and M Tornado 9000 box of 10

Oct 10, 2025Hayati Pro Max 4000 Box of 10

Oct 10, 2025Crystal Prime Deluxe 18000 box of 10

Oct 10, 2025Custom Postcard Printing vs. Template Postcards

Oct 10, 2025What’s New in Ok Win Game 2025 Update

Oct 10, 20257 Essential Tips to Pick the Perfect Corner

Oct 10, 2025Plant Engineering Experts in Montana

Oct 10, 2025Comfort, Safety & Ease of Travel with Coach

Oct 09, 2025What is the Difference Between Fire Bricks and

Oct 09, 2025How Pain Treatment Centers Use Technology for Better

Oct 09, 2025Shop Omada Cordless Grass Trimmers Now

Oct 09, 2025Ford Rental Dubai – Drive Style, Strength, and

Oct 08, 2025Learn How to Stay Consistent with Every Colour

Oct 08, 2025A Guide to Maid Services and Home Cleaning

Oct 08, 2025Discover the Best House Cleaning and Maid Services

Oct 08, 2025New Standard of Clean with House Cleaning Service

Oct 08, 2025Can You Avoid Airline Cancellation Fees on Cash

Oct 08, 2025Premium Delta & E-Cigarette Boxes – Redefine Luxury

Oct 08, 2025Cat Eye Bracelet – Protection, Clarity & Balance

Oct 07, 2025What Makes the 6 Club Worth Trying for

Oct 07, 2025Impact of Leavening Agents on Cake Texture

Oct 07, 2025Enterprise Application Development Company

Oct 07, 2025Tips to Organize your Schedule and Dispatch

Oct 07, 2025Empower Your Business with a Leading IT Solutions

Oct 06, 2025Tashan Game Free Recharge – Play, Win &

Oct 06, 2025How to Get a Virtual Office Address in

Oct 06, 2025Tattoo Pricing in Phuket with All the Details

Oct 06, 2025Bharat Club Colour Trading App – Win Real

Oct 06, 2025What Are Refractory PCPF Blocks and Where Can

Oct 04, 2025DLF The Magnolias Gurgaon – The Epitome of

Oct 03, 2025Teacher’s Guide to Top AI Checker Tools for

Oct 03, 2025Body Waxing for Sensitive Skin: Best Practices

Oct 03, 2025HR Software in India vs Traditional HR Methods:

Oct 03, 2025The Best DST File Converters for Smooth Results

Oct 03, 2025Celebrate Together: Festival Trips with a 50 Seat

Oct 02, 2025Party Bus Hire for Memorable City Journeys

Oct 02, 2025Why Halloween Candy Bracelets Are a Fun Gift

Oct 02, 2025Office Pantry Service for Workplaces

Oct 01, 2025Mahakoshal Refractory Fire Bricks in OMAN | Supplier

Oct 01, 2025Micro Market Vending Machines for Workplaces

Oct 01, 2025Best Fire Bricks in Ghaziabad | Manufacturer |

Oct 01, 2025The Art & Science Behind Perfect Baking

Oct 01, 2025Refractory Fire Bricks in Bhiwadi by BM Enterprises

Sep 30, 2025Which Business Card Design Works Best for You?

Sep 30, 2025Uratech Tool Carts and CNC Cabinets- Built for

Sep 30, 2025The Complete Guide to Digital Visiting Cards

Sep 30, 2025Professional Photography Services: Capturing Moments

Sep 29, 2025Lubricants Market to Witness Promising Growth

Sep 29, 2025How To Choose The Best Holographic Mylar Bags

Sep 29, 2025Fast Track Driving Licence: The Quickest Way to

Sep 29, 2025Face Serums in Lahore – Unlock Radiant Skin

Sep 29, 2025The 80/20 Rule: How the Pareto Principle Transforms

Sep 29, 2025Essentials Fear Of God Pullover Hoodie Black

Sep 27, 2025Flip or Decide: The Modern Way to Make

Sep 26, 2025Crystal Prime Deluxe 18000 Puffs Box of 10

Sep 26, 2025WGA Crystal 20000 Puffs Box of 10

Sep 26, 2025R and M 30000 Puffs box of 10

Sep 26, 2025Crystal Pro Max + 10000 Box of 10

Sep 26, 2025Crystal Prime Pro 4500 Puffs Box of 10

Sep 26, 2025WGA Crystal Pro Max 15000 puffs Box of

Sep 26, 2025Hayati Pro Ultra 15000 Puffs Box of 10

Sep 26, 2025Crystal Prime 7000 Puffs Box of 10

Sep 26, 2025Enjoy Ultra 9000 Puffs Box of 10

Sep 26, 2025R and M 15000 puffs box of 10

Sep 26, 2025R and M 9000 puffs box of 10

Sep 26, 2025What Makes the Best Wrap Around Soap Labels

Sep 26, 2025Hayati Pro Max 4000 Box of 10

Sep 26, 2025SIE Practice Questions: Tips and Strategies to Pass

Sep 26, 2025The Future of VR & AR in 3D

Sep 26, 2025Future of ONDO: ONDO Price Prediction and Investment

Sep 26, 2025Digital Growth Made Simple with DigiAtmos Solutions

Sep 26, 2025Blinds Installation White Plains NY – Transform Your

Sep 25, 2025Coach Hire UK with Routes to London

Sep 25, 202550 Seater Coach Hire for Stratford to Stansted

Sep 25, 2025What Can You Do About Modafinil at Buy

Sep 25, 2025The Best Option for Heathrow Travel: Coach Hire

Sep 25, 2025Side Gig to Main Job: Earn with AI

Sep 25, 202550 Seater Coach Hire Prices: Affordable Group Travel

Sep 24, 2025Exploring Comfort with UK Coach Hire for Long

Sep 24, 2025UK Coach Hire for Stress-Free Group Travel Across

Sep 24, 2025Hayati Pro Max Plus 6000 Puffs

Sep 24, 2025Preact vs React: Choosing Right JavaScript for Your

Sep 24, 2025How to Optimize Your Ecommerce Website for Organic

Sep 24, 2025How It Compares to Traditional Facials for Lasting

Sep 24, 2025Prepared Meals Delivered NJ: Tasty Nutrition at Your

Sep 23, 2025Start Your Group Adventure: 16 Seater Minibus Hire

Sep 23, 2025Simple Stock Analysis: 5 Steps to Find Profitable

Sep 23, 2025How to Minimize Wrinkles and Fine Lines on

Sep 23, 2025Guide to Infant Headband Bows: Style, Comfort, and

Sep 23, 2025Minibus Hire Walsall: Perfect for Day Trips &

Sep 23, 2025Types of Custom Outdoor Retail Signage

Sep 23, 2025Comfortable 7 Seater Taxi for Heathrow & Gatwick

Sep 23, 2025Blending Fun and Learning: How Online Phonics Makes

Sep 22, 2025Payroll Outsourcing: A Smarter Way to Manage Growth

Sep 22, 2025Shine India: Best place for Currency Solutions in

Sep 22, 2025Track IPO Subscriptions in Real-Time with These 7

Sep 22, 2025Trendy Unstitched Fabrics Frocks for Every Occasion

Sep 20, 2025How To Replace Defy Spare Parts For Lasting

Sep 20, 2025Custom Embroidery Patches and Quick Delivery Service

Sep 19, 2025Why Solar Energy with Battery Storage Is the

Sep 19, 2025Top-Rated Credit Conversion Experts in Okatie, SC

Sep 19, 2025The Sweetest Symbol of Love and Celebration

Sep 18, 2025Lanvin: Critiques of Scarcity in Merch

Sep 18, 2025High-Quality Essentials Hoodie for Daily Use

Sep 18, 2025“Best Way to Ship Car from Georgia to

Sep 18, 2025The Role of Panel Beaters in Restoring Structural

Sep 18, 2025Essentials Hoodie for Athleisure Outfits

Sep 17, 2025Essentials Hoodie Clean and Classic

Sep 17, 2025$uicideboy$ Merch That Doesn’t Sugarcoat Pain

Sep 17, 2025Your Adventure Look XPLR Merch

Sep 17, 2025$uicideboy$ Merch for Those Who Feel the Lyrics

Sep 17, 2025HydraFacial vs. Regular Facials – Which One Is

Sep 17, 2025Why Bakers Around the World Swear by Madagascar

Sep 17, 2025How to Save Money on London’s Premier Photography

Sep 17, 2025The Life of a Dozer: From Forest Clearing

Sep 17, 2025Central Park 104 – Redefining Luxury Living in

Sep 17, 2025Can Leather Kilts Replace Trousers in Men’s Everyday

Sep 17, 2025Best Gynecologist in Lucknow for Normal Delivery

Sep 16, 2025Dashing Guide to Choosing the Best Gift Boxes

Sep 16, 2025How Custom Brochure Printing Builds Brand Trust

Sep 16, 2025How Gold Trading Signals and XAUUSD Signals Help

Sep 16, 2025How to Apply for a British Passport:

Sep 16, 2025Expert Public Relations Tourism Services for 2025

Sep 15, 2025Expert SaaS Public Relations for Modern Tech Brands

Sep 15, 2025Top 10 Sig Sauer New Products Every Firearm

Sep 15, 20255 Effective TMJ Pain Relief Stretches for Gallup

Sep 15, 2025Dental Implants and Oral Hygiene: Best Practices for

Sep 15, 2025How to Manage Minor Orthodontic Issues at Home

Sep 15, 2025Can You Legally Use a Virtual Office for

Sep 15, 2025Choose the Best Digital Marketing Company for Your

Sep 15, 2025Opal and Tourmaline Meaning: The Dual Gems of

Sep 15, 2025History of Lederhosen: From Work Trousers to Cult

Sep 15, 2025Mastering ISO 13485 internal auditor training online

Sep 15, 2025How Can Custom Bath Bomb Boxes Improve Brand

Sep 15, 2025How Can Retailers Use Custom Cube Boxes Effectively?

Sep 15, 2025How Can Fast Food Boxes Boost Restaurant Branding?

Sep 15, 2025Greece Golden Visa Residency by Investment Program

Sep 15, 2025What Makes Rigid Candle Boxes Ideal for Luxury

Sep 15, 2025What Makes Cube Boxes Essential for Branding?

Sep 15, 2025How Can Custom Cigarette Boxes UK Improve Your

Sep 15, 2025The Role of Metal Fabrication in Modern Australia

Sep 15, 2025Can CCTV Cameras Be Jammed? Understanding Risks &

Sep 15, 2025Maximize Packaging Impact With Custom Pillow Boxes?

Sep 15, 2025How Can Custom Kraft Boxes Enhance Your Brand’s

Sep 15, 2025Benefits Do Small Businesses Get From Custom Printed

Sep 15, 2025Elevate Your Brand with Custom Beverage Packaging

Sep 15, 2025Durable Custom Bagel Boxes for Your Bakery

Sep 15, 2025Boost Sales with Custom Waffle Boxes

Sep 15, 2025Custom Action Figure Boxes Boost Toy Brand Marketing

Sep 15, 2025How to Optimize Layouts for Cheese Paper in

Sep 15, 2025How to Create Brand Visibility with Food Basket

Sep 15, 2025How Can Businesses Improve Layouts for Custom Food

Sep 15, 2025Civil Surveyor Course in Rawalpindi

Sep 15, 2025German Language Classes in Jaipur

Sep 14, 2025Essential Hoodie Your New Go-To

Sep 13, 2025Best Futures Prop Firms for Traders Looking to

Sep 13, 2025Best USB Flash Drive 2025 in New York

Sep 13, 2025Chrome Hearts Urban Street Hoodie

Sep 13, 2025AI Agents: Redefining the Future of Business

Sep 13, 2025Travis Scott Merch and Pink Palm Puff Guide

Sep 13, 2025How to Style Essentials Clothing for a Night

Sep 13, 2025Wearing Eric Emanuel Shorts With Always Do What

Sep 13, 2025Custom Packaging: A Powerful Tool for Modern Brands

Sep 12, 2025Buy Adderall in the USA at an Affordable

Sep 12, 2025Buy Adderall Online Next Day Shipping Available

Sep 12, 2025Buy Adderall Online with US Domestic Shipping

Sep 12, 2025Buy Adderall Online – Pay with Paypal

Sep 12, 2025Your Path to Fluency: The Premier German Language

Sep 12, 2025Celebrate in Style with Luxury Party Bus Hire

Sep 12, 2025Travel in Comfort with Modern UK Coach Fleet

Sep 12, 2025Your Definitive Guide: How to Import from China

Sep 12, 2025UK Coach Hire for Comfortable Birmingham to London

Sep 12, 2025See the World in Style: Discover Ray-Ban Sunglasses

Sep 12, 2025Group Adventures Made Simple with Minibus Hire Near

Sep 12, 2025Discover How Ratul Puri Is Helping India Reach

Sep 12, 2025How to Care for Moonstone: Protecting Its Delicate

Sep 12, 2025Why Soft Skills Matter More Than Ever in

Sep 12, 2025Crowns, Bridges, and Dentures in Sharjah: Care at

Sep 12, 2025Seeing the World in True Colors: Why Gray

Sep 12, 2025Cheap Coach Hire in the UK | Reliable

Sep 12, 2025How Many Calories in an Apple – Nutritional

Sep 12, 2025How AI is Revolutionizing HVAC Technology

Sep 12, 2025Best Lightweight Formal Wear for Hot Weather

Sep 11, 2025Affordable Handyman Services in Okatie You Can Trust

Sep 11, 2025Pre Wedding Photoshoot Outfits and Poses That Always

Sep 11, 2025Recycle Your Mobile Device: Get Top Value for

Sep 11, 2025Why White Label SMM Is a Strategic Edge

Sep 11, 2025Professional Teeth Whitening in Aldershot – Safe &

Sep 11, 2025Increase Leads with Proven SEO Services for Health

Sep 11, 2025Streetwear by Travis Scott and Pretty Little Thing

Sep 11, 2025Why You Should Choose Sliding Doors for Natural

Sep 11, 2025What Hidden Stories Lie Behind Every Cup of

Sep 11, 2025Roadstone vs Goodyear: Which Tyre Brand Wins?

Sep 11, 2025How to Choose Boudoir Photography Virginia Beach and

Sep 11, 2025How to Style Your Home Like a Pro

Sep 11, 2025SEO In the Era of AI: Emerging as

Sep 10, 2025Morris Town Limo Chauffeur Driven Car Hire

Sep 10, 2025VIP Travel Experience with Black Swan Chauffeurs

Sep 10, 2025How to Choose the Best Graphics Designing Company

Sep 10, 2025How to Find the Perfect Expert for Your

Sep 10, 2025From Stussy Hoodies to Broken Planet Market: Inside

Sep 10, 2025What is Custom Plasma Cutting and Its Role

Sep 10, 2025How to Balance Work and Study to Advance

Sep 10, 2025Luxury Apartments in Lucknow – A New Standard

Sep 10, 2025We Buy Houses in Georgetown Fast – Get

Sep 10, 2025Car Rental at CLT Your Guide to Travel

Sep 10, 2025Cash House Buyers in Boulder City: Sell Your

Sep 09, 2025Carpets in Dubai: Elevate Your Home with Luxurious

Sep 09, 2025We Buy Houses In Milton Florida – Sell

Sep 09, 2025How to Choose the Best Plumber in Golden

Sep 09, 2025Car Service to Raleigh NC Airport | Affordable,

Sep 09, 2025What to Expect When Ordering Custom Printed Yard

Sep 08, 2025Winter Fashion Redefined with High Neck Sweaters for

Sep 08, 2025The Advanced Vaporesso Luxe Q2 SE for Ultimate

Sep 05, 2025Floor Plans Designed for Comfort and Modern Living

Sep 05, 2025Why 2026 Could Be the Best Year to

Sep 04, 20255 Key Tools for Quality Control and Assurance

Sep 03, 2025JetBlue Airlines Flight Change Policy: A Guide To

Sep 03, 2025Properties on Ayodhya Road Lucknow – A Modern

Sep 03, 2025Fast Business Loans: A Quick Solution for Growing

Sep 02, 2025Overcoming Sales in the Hybrid Era: New Tactics

Sep 02, 2025Master Forex Skills with a Trading Demo Account

Sep 01, 2025Site Plan Overview for Comfortable and Modern Living

Sep 01, 2025How Wooden Pallets Are Used in the Transport

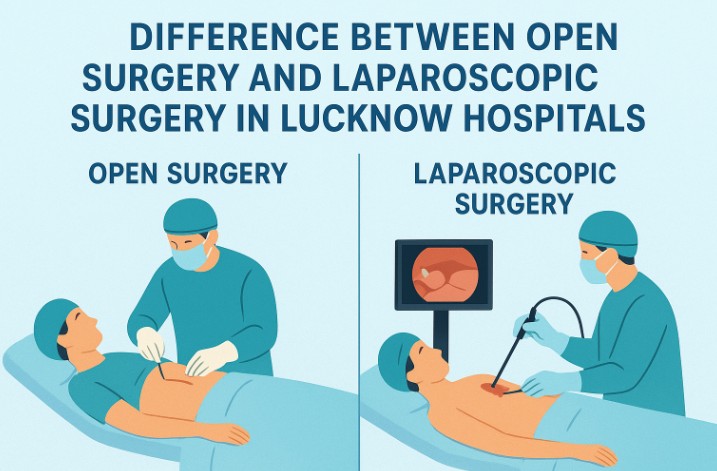

Aug 30, 2025Types of Plastic Surgery in Lucknow: Cosmetic vs.

Aug 29, 2025Couples Therapy Near Me: How Local Experts Help

Aug 29, 2025What SEO Services Do Agencies Typically Offer?

Aug 29, 2025Brand Logo Designing and Logo Digitizing Services

Aug 29, 2025Top Website Design Trends to Watch in 2025

Aug 28, 2025Smart Cash Handling: Organize with a Locked Money

Aug 28, 2025Why Should You Call a Locksmith in Pimlico

Aug 28, 2025How Cloud Services Drive Innovation in Startups

Aug 27, 2025Vintage Car Rental in Jaipur – Royal Cars

Aug 26, 2025Find the Best Kids Photography Near Me –

Aug 25, 20255 Ways Cloud Services Help Startups Compete with

Aug 21, 20253 Best MOD APK Games That Make Every

Aug 21, 2025Expert Painters and Basement Remodeling in Cambridge

Aug 21, 2025Why You Need a Criminal Immigration Lawyer:

Aug 20, 2025Transportation and Logistics Management Solutions

Aug 20, 2025Best SEO Services in Delhi: How Local Agencies

Aug 20, 2025Top 8 Places to Visit in Puri

Aug 18, 20255 Common Myths About Home Window Tinting Louisville

Aug 18, 2025Popular Places to Visit During Adi Kailash Yatra

Aug 18, 2025Why Pakistani Wedding Dresses at Rang Jah Trending

Aug 16, 2025How to Apply a Wig Perfectly: Complete Guide

Aug 16, 2025Couples Dance Lessons and Wedding Dance Classes:

Aug 15, 2025Plan Romantic Xitang Tours with Your Way Holiday

Aug 13, 2025Best Banquet Halls with Top Catering Services

Aug 12, 2025Leyla Alaton Biography – Inspiring Life, Career &

Aug 12, 2025Is Hair Transplant in Pakistan Worth It? A

Aug 12, 2025Ivermectin Iverheal 12 mg – Uses, Benefits, Dosage,

Aug 12, 2025Where to Find Scenic Homestay in Sonmarg?

Aug 11, 2025Minimalist Look, Maximum Comfort – Essential Hoodie

Aug 09, 2025Electric Fireplaces: The Perfect Blend of Style and

Aug 09, 2025Cloud Storage: The Future of Data Management in

Aug 09, 2025The Perfect Blend of Durability and Style

Aug 08, 2025The Benefits of Using Cat5e CMP in Commercial

Aug 08, 2025Boost Your Child’s Success with Online English and

Aug 08, 2025VMware Horizon Cloud License Supplier in India

Aug 08, 2025How Custom Wood Hoods Add Character to Any

Aug 07, 2025Shop All Men’s Footwear Without Regret: A Zero-Fluff

Aug 07, 2025Damac Lagoons Property for Sale | Waterfront Homes

Aug 07, 2025Why Hiring a PPC Expert Can Skyrocket Your

Aug 07, 2025What to Look for When Buying a Basketball

Aug 07, 2025Why Hiring an AdWords PPC Consultant Boosts Your

Aug 07, 2025Top Reasons to Invest in Dubai Real Estate

Aug 07, 2025What Are the Benefits of Working with a

Aug 07, 2025Need Taxis to Heathrow Near Me? Here’s What

Aug 07, 2025What is the Best Tour Group for Iceland?

Aug 07, 2025Why Hair Transplant in Pakistan Is Gaining Global

Aug 07, 2025Elementor #22458

Aug 07, 2025How AdsDiary Became the Best SEO Company in

Aug 07, 2025Stämning dolda fel: Din kompletta juridiska guide

Aug 07, 2025Why Brides Love Pakistani Mehndi Dresses at Rang

Aug 07, 2025Where Junior Jewels Shirt Become Pop Culture Icons

Aug 07, 2025Golden Visa for Real Estate Investors Guide to

Aug 07, 2025Corteiz Streetwear Essentials: How to Build a Trendy

Aug 06, 2025A Precision Solution for Modern Industrial Demands

Aug 05, 2025How Beewel Ensures the Purity of Every Drop

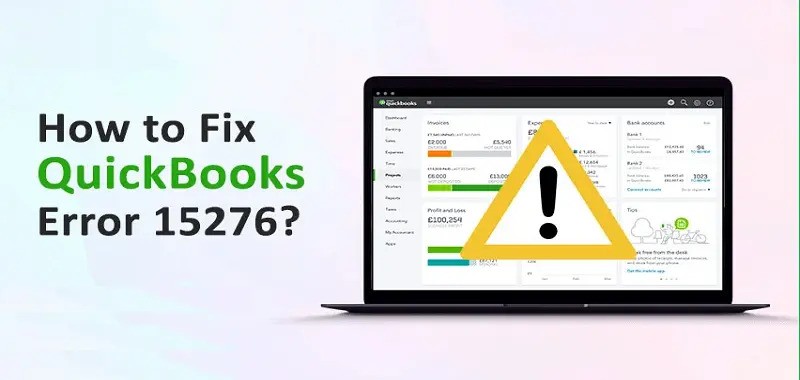

Aug 02, 2025QuickBooks Error 15276 | Payroll File In Use

Jul 30, 2025Chic and Modern Rings for Girls at WearItWell.pk

Jul 30, 2025The Critical Role of Event Medical Services in

Jul 30, 2025Are You Experiencing Varicocele Grade 4 Symptoms?

Jul 30, 2025White Label SEO Reseller Company to Help You

Jul 30, 2025Smart Use of MyMathLab Answers to Succeed in

Jul 28, 2025North Miami Car Accident Lawyer – The Perazzo

Jul 28, 2025Top Reasons to Use a Certified NAATI Translator

Jul 28, 2025Why a NAATI Translator Is Key to Trusted

Jul 26, 2025The Value of CNC Machining in Modern Precision

Jul 26, 2025Next-Gen Fashion 2025: The Power of Accessories

Jul 26, 2025Volleyball Net Height Guide: Rules, Sizes & Pro

Jul 26, 2025What To Know Before Getting Spray Foam Insulation

Jul 24, 2025Upgrade Your Basement with Durable and Stylish Floor

Jul 23, 2025Drift Hunters and the Rise of Browser-Based Racing

Jul 23, 2025Dordle: A Double Dose of Word Puzzle Fun

Jul 23, 2025Best Forex Trading Platforms | Tradewill

Jul 23, 2025Fai tornare il tuo PC come nuovo con

Jul 22, 2025Evan Bass Men’s Clinic Discusses the Importance of

May 21, 2025Charles Spinelli Unlocks the Secrets of Designing a

May 19, 2025What to Expect from a Financial Advisor in

May 17, 2025Steven Rindner On Impact of Weather Conditions in

May 15, 2025Is Post-Op IV Ozone Therapy Useful for Joint

May 03, 2025How Do You Take Care of Your Vehicle

May 03, 2025Does Oxygen Facial Reduce Large Pores Too?

May 03, 2025Discover the Bold Streetwear Power of the Iconic

May 03, 2025Choose VIP Travel Agency for Luxury Adventures

May 02, 2025Why Choose HydraFacial for Flawless Skin in Dubai?

May 02, 2025Bitachon for Beginners: A Quick Guide

May 02, 2025Top Skin Whitening Treatments in Dubai: A Quick

May 02, 2025Download GB WhatsApp APK – Updated Version (2025)

May 02, 2025Top Guma – Affordable Tires for Every Car,

May 02, 2025Top Guma – Wide Selection of Car Tires

May 02, 2025GV GALLERY® || Raspberry Hills Clothing Store ||

May 02, 2025How Does Wegovy Injections Compare to Saxenda?

May 02, 2025Resume writing services – hirex

May 02, 2025Finding the Best Naperville Fence Company for Your

May 02, 2025Unlock the Power of Numbers with a Numerology

May 02, 2025Title: Top Online Game Genres to Watch in

May 02, 2025Who Is the Biggest Enemy of Lord Vishnu

May 02, 2025Reliable Manchester to Airport Taxi Service – Fixed

May 02, 2025Complete Greenhouse Solutions by EKO TEPLYTSIA Kyiv

May 02, 2025How Henceforth Leads as a Premier App Development

May 02, 2025High-Quality Jewellery Design CAD Files Online

May 02, 2025Tassie-Tough MTA: Where Stability Meets Progress

May 02, 2025The Ultimate Guide to ISO Training: Top Management

May 02, 2025Crafting Cute and Creative Party Decor for Every

May 01, 2025Halal Certification: What It Is and Why It’s

May 01, 2025How Professional CIPD Help Can Boost Your Academic

May 01, 2025Choosing the Right Retirement Homes in Sydney: A

May 01, 2025Drive in Style with Premium Android Car Radios

May 01, 20256+ Years of Quality Android Car Stereo Installations

May 01, 2025Reliable Romiley to Manchester Airport Taxi Service

May 01, 2025United States Semiconductor Market Size & Share |

May 01, 2025Masters in Ireland for Indian Students: Best IT

May 01, 2025One Goal. One Result. The Best CUET Coaching

May 01, 2025Top Castles and Palaces to Visit in Hungary

May 01, 2025How to Choose the Best PPC Management Company

May 01, 2025Living Room Design Tips from a Knoxville Remodeling

May 01, 2025Are One-Size-Fits-All Marketing Services Worth It?

May 01, 2025Badson US || Official Badson Clothing Store ||

Apr 30, 2025Bajaj Pulsar NS 160: The Perfect Bike for

Apr 30, 2025محل عطور فاخر يقدم أجود الروائح وتجربة تسوق

Apr 30, 2025The Timeless Allure of Agarwood Oud

Apr 30, 2025Hire Laravel developer at affordable price

Apr 30, 2025Is ClearLift Laser Suitable for Mature Skin?

Apr 30, 2025Is PDO Mono Threads Right for Your Skin?

Apr 30, 2025ISO 45001 Training: Essential Steps for a Safer

Apr 30, 2025Trusted Mobile Notary in Pasadena – Fast &

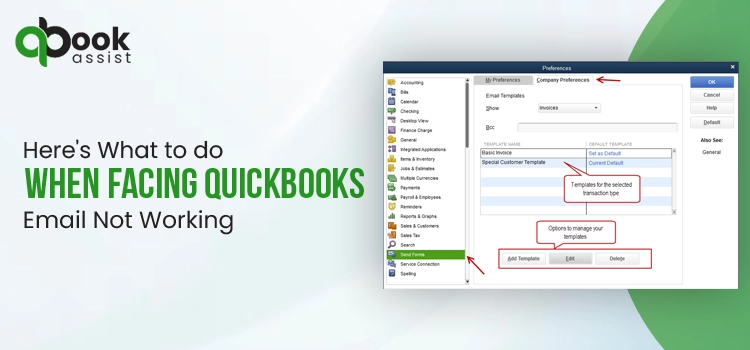

Apr 30, 2025Proven Facts to Fix QuickBooks Error Code 15276

Apr 30, 202510 Compelling Reasons to Buy Space Binoculars

Apr 30, 2025Why Are i7 Laptops Still the Top Pick

Apr 30, 2025What Is Rhinoplasty and How Does It Work?

Apr 30, 2025Unlocking Pharma Success with Real World Data in

Apr 29, 2025Top SEO Services in Los Angeles: Boost Your

Apr 29, 2025Does ClearLift Laser Work on Acne Scars?

Apr 29, 2025Is Hair Transplant Effective for Balding Men?

Apr 29, 2025Insurance Company in Abu Dhabi – Tailored Solutions

Apr 29, 2025GB WhatsApp APK Download 2025 (Latest Version)

Apr 29, 2025Is Fat Injections Better Than Fillers for Facial

Apr 29, 2025Reliable Taxi from Stockport to Manchester Airport

Apr 29, 2025Luxury Sprinter Van Limo Service – Comfort, Style

Apr 29, 2025Our Uniting Classic USA Craft with Chrome Heart

Apr 29, 2025How a Web Development Company Builds Websites That

Apr 29, 2025How a Moisture Analyzer Improves Product Quality

Apr 29, 2025Reporting CSRD : Automatisez vos processus

Apr 29, 2025Top 10 Features to Look for in a

Apr 29, 2025Top Platforms to Sell Google Play Gift Card

Apr 29, 2025Dust Collector Manufacturer in India

Apr 29, 2025Pharmacovigilance in New Zealand – DDReg Pharma

Apr 29, 2025The #1 Natural Snoring Solution — NiteHush Pro

Apr 29, 2025Understanding Mental Health: A Beginner’s Guide

Apr 29, 2025How to Choose Perfume Based on Personality?

Apr 29, 2025Pharma Commercial Analytics and Consulting in 2025

Apr 29, 2025Best Airport Limo Service – Comfort, Luxury, and

Apr 29, 2025Fast Car Battery Replacement in Abu Dhabi –

Apr 29, 2025Mobile Tyre Repair in Abu Dhabi: 24/7 Roadside

Apr 29, 2025Complete Guide to Car Towing Services : 24/7

Apr 28, 2025Why Companies Need a Better Strategy for a

Apr 28, 2025Top Features to Look for When Developing Book

Apr 28, 2025Southampton Limo Service | Luxury Car & Airport

Apr 28, 2025Black Leather Coat for Women for Effortless Winter

Apr 28, 2025Top 7 Secrets to Extend Your Car AC

Apr 28, 2025Taxi from Glasgow to Manchester Airport | Affordable

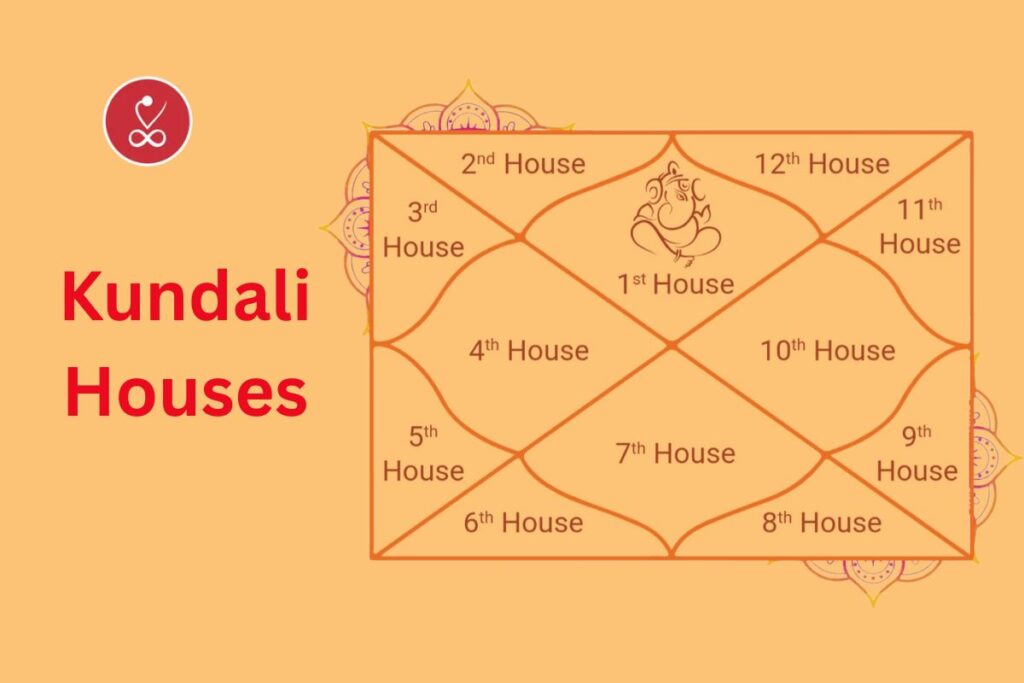

Apr 28, 2025Kundali Houses Explained: Your Horoscope Secrets

Apr 28, 2025Top 10 Business Schools in Jaipur You Shouldn’t

Apr 28, 2025Why Invest in Property in Sector 10 &

Apr 28, 2025How to Choose the Right Solar Battery for

Apr 28, 2025Is Freckles and Blemishes Treatment Permanent?

Apr 28, 2025Unique Themes for Adelaide Wedding Receptions

Apr 28, 2025How to Grow Your Instagram Followers: A Strategic

Apr 28, 2025Book Trusted Newark Airport Limo Services | Noor

Apr 27, 2025GB WhatsApp APK (2025) – Latest Version Download

Apr 27, 2025Badson US || Official Badson Clothing Store ||

Apr 27, 2025Why Corteiz Hoodie is Perfect for Everyone

Apr 26, 2025Does Orlebar Brown Clothing Provide Fabric of the

Apr 26, 2025The Loverboy Hat: A Revolutionary Symbol in the

Apr 26, 2025In Glock We Trust Shirt has the most

Apr 26, 2025Why Sp5der Hoodie Is The Best Accessory You

Apr 26, 2025The Emergence of Hellstar Clothing in the Fashion

Apr 26, 2025Serenede jeans– Top Quality Brand

Apr 26, 2025Everything You Need to Know About Swiss Oud

Apr 26, 2025Top 8 Hayati Pro Max 6000 Flavours that

Apr 26, 2025Everything You Need to Know About Premium Oud

Apr 26, 2025Les meilleures saveurs de vapotage de Ghost Pro

Apr 26, 2025Complete Information on Original Oud Attar and Its

Apr 26, 2025De beste vaping smaken van Ghost Pro 3500

Apr 26, 2025Everything You Need to Know About White Oud

Apr 26, 2025Everything You Need to Know About Deer Musk,

Apr 26, 2025Everything You Need to Know About Oud Hindi:

Apr 26, 2025Unlock Your Week: Aquarius Weekly Horoscope Guide

Apr 26, 2025Does Acne Scar Treatment Lighten Dark Marks?

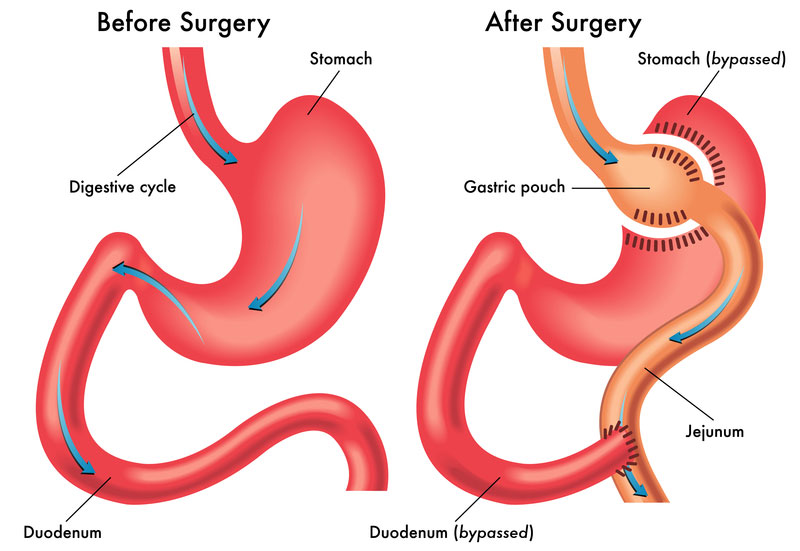

Apr 26, 2025Affordable Gastric Bypass Surgery for Weight Loss in

Apr 25, 2025The Pros and Cons of Static Site Generators

Apr 25, 2025Affordable Men’s Fashion: Best Stores to Shop

Apr 25, 2025Boost Your BPO Performance with Smart CRM Software

Apr 25, 2025How to Raise Emotionally Strong Kids as a

Apr 25, 2025Gallery Dept T-Shirt: Streetwear

Apr 25, 2025How to Make Your Hair Look Shiny and

Apr 25, 2025Is Your Hampshire Website Mobile-Friendly?

Apr 25, 2025Top 10 Electrical Companies in Dubai

Apr 25, 2025Unlock the Web with CroxyProxy – The Ultimate

Apr 25, 2025What are the common mistakes that you have

Apr 25, 2025How to Maintain Non-Surgical Hair Replacement?

Apr 25, 2025The Benefits of Hiring a Local Canberra Wedding

Apr 25, 2025Need a Blocked Sink Fix in Stourbridge? Contact

Apr 25, 2025Boost Your Business with Local SEO Services in

Apr 24, 2025San Diego SEO Services for Higher Rankings &

Apr 24, 2025Real Estate App Development: Essential to Build a

Apr 24, 2025Empyre | Empyre Jeans & Pants | Official

Apr 24, 2025The Rise of Natural Skin Care: Is Makeup

Apr 24, 2025Level Up Your Irrigation Game with These Top-Rated

Apr 24, 2025Soil Pipe Blocked Again? Here’s How to Solve

Apr 24, 2025Struggles Faced by New Moms & Tips to

Apr 24, 2025The Best Passive Real Estate Investment Options in

Apr 24, 2025The Pros and Cons of Investing in Custom

Apr 24, 2025Website Design Pitfalls for Small Businesses: How to

Apr 24, 2025The Role of SEO Tools in a Data-Driven

Apr 24, 2025Choosing the Right Electrician in Adelaide

Apr 24, 2025How Retargeting Can Drive Conversions and Boost ROI

Apr 24, 2025How to Choose the Right Disability Support Provider

Apr 24, 2025Private Taxi from London to Manchester Airport –

Apr 24, 2025How Technology is Changing the Path of Marriage

Apr 24, 2025Mukhyamantri Kisan Kalyan Yojana

Apr 24, 2025Is Organic Pumpkin Peel Better Than Chemical Peels?

Apr 24, 2025Building Smart Chatbots with PHP for Better UX

Apr 24, 2025Professional Help With Writing Thesis for Students

Apr 24, 2025The Kashyap Samhita and the Role of CSS

Apr 24, 2025NYC Cleaning & Maintenance – Trusted Experts for

Apr 23, 2025The Ultimate Guide to : A Luxurious Travel

Apr 23, 2025Realme 2025 Vision: AI Smartphones, & What’s Next

Apr 23, 2025How to Save Money on Car AC Repairs:

Apr 23, 2025Elevating Hygiene Standards in Every Space

Apr 23, 2025Top Certifications Pursue Alongside Your MS in Data

Apr 23, 2025Why Gold Bracelets Are a Must-Have in Every

Apr 23, 2025Smart Property Management Across the New York Metro

Apr 23, 2025Everything You Need to Know About Tummy Tuck

Apr 23, 2025Leo Daily Horoscope – Your Complete Guide

Apr 23, 2025Why Sure Shade Is the Leading External Venetian

Apr 23, 2025The Truth About Finding a Limo Service That’s

Apr 23, 2025Top Benefits of Virtual Office Valdosta GA for

Apr 23, 2025Your Guide to Luxury and Reliability in Northern

Apr 23, 2025UnitConnect: Simplify Commercial Property Management

Apr 23, 2025Smarter Real Estate Tools with UnitConnect Software

Apr 23, 2025How to Safely Overclock with the Intel Overclocking

Apr 23, 2025What Interest Rate Hikes Really Mean for Stock

Apr 23, 2025The Powerful Ruby: Discover the Top Ruby Gemstone

Apr 23, 2025Affordable Taxi from London to Manchester Airport

Apr 23, 2025Unlocking the Secrets of the Triangle in Palmistry

Apr 23, 2025Best IT Services in Oakland for Startups &

Apr 23, 2025How do I speak to someone at Breeze?

Apr 23, 2025How do I talk to a real person

Apr 23, 2025Buy Get Well Soon Flower Online for Her

Apr 23, 2025California Needs Drivers: Apply Now for the Best

Apr 23, 2025Botox Isn’t Just for Women: Men Embrace a

Apr 23, 2025Master Tableau with Expert Tableau Assignment Help

Apr 23, 2025The Rise of Cortiez Cargos: A Streetwear Staple

Apr 23, 2025Essentials Shorts: The Perfect Blend of Comfort and

Apr 22, 2025Why Choosing a Content Writing Agency in Houston:

Apr 22, 2025How to Use Your Intuition to Create Magnetic

Apr 22, 2025Mastering Evidence-Based Practice in NURS-FPX 4030

Apr 22, 2025Is Male Hair Loss Fixed by Best Trichologists?

Apr 22, 2025Food Safety Leader: FSSC 22000 Lead Auditor Course

Apr 22, 2025Top 10 Things to Know Before Visiting Maine

Apr 22, 2025Top Benefits of Installing Sliding Glass Doors in

Apr 22, 2025Book Trailer Services: A Smart Way to Promote

Apr 22, 2025Everything You Need to Know About Buying a

Apr 22, 2025Trusted Experts for Quality Cleveland Roof Repairs

Apr 22, 2025ISO 9001 Lead Auditor Training in Bangalore

Apr 22, 2025Broken Promises and the Healing Power of God

Apr 22, 2025How to Choose the Best Body Spa in

Apr 22, 2025Originalteile und Nachbauteile bei ORAP GMBH

Apr 22, 2025Original- und Nachbauteile direkt vom Fachhändler

Apr 22, 2025Ihr Partner für hochwertige Autoteile im Groß- und

Apr 22, 2025Get Your Towbar Fitted by Experts in Bishop’s

Apr 22, 2025How Body Pillow Shapes Affect Your Spine, Joints,

Apr 22, 2025The Role of Solar Power in Sustaining Military

Apr 22, 2025Which Areas in Dubai Have the Most Promising

Apr 22, 2025Why ISO 14001 Lead Auditor Training Could Be

Apr 22, 2025Discover New Builds in Easton: Modern Living

Apr 22, 2025Tips to choose the best kids backpack

Apr 22, 2025How Is G Cell Treatment Different From PRP?

Apr 22, 2025Which Football League Offers the Best Tactical Depth

Apr 22, 2025Is Renting or Buying a Home Better for

Apr 22, 2025A Smarter Way to Trade Stocks, Forex, and

Apr 22, 2025Graceful Church Suits Every Woman Should Own

Apr 22, 2025Recruitment agency in delhi- hirex

Apr 22, 2025Badson US || Official Badson Clothing Store ||

Apr 22, 2025Corteiz Clothing UK RTW Official Store | Cortiez

Apr 21, 2025Explore Livingston Park and Cabin Rentals in Texas

Apr 21, 2025Best Peking Duck and Curry Crab in Houston

Apr 21, 2025Finding the Right Pet Veterinary Clinic in Qatar

Apr 21, 2025Maximize Space and Style with Stackable and Metal

Apr 21, 2025Embrace the East with Every Sushi Roll at

Apr 21, 2025Sushi Point: Discover the True Spirit of Sushi

Apr 21, 2025Authentic Eastern Flavors, Perfected at Sushi Point

Apr 21, 2025How Do i5 and i7 Processors Compare for

Apr 21, 2025Samsung A26 Price in Pakistan – Specs You

Apr 21, 2025Technical SEO Done Right: Tips from a San

Apr 21, 2025Affordable SEO Services: A Comprehensive Guide

Apr 21, 2025Does Fat Injections Help Sculpt the Body?

Apr 21, 2025MBA in HR Management in Jaipur: Classroom to

Apr 21, 2025Everything You Need to Know About Liposuction in

Apr 21, 2025Find out what colleges in Jaipur offer mechanical

Apr 21, 2025Private Taxi from Blackpool to Manchester Airport –

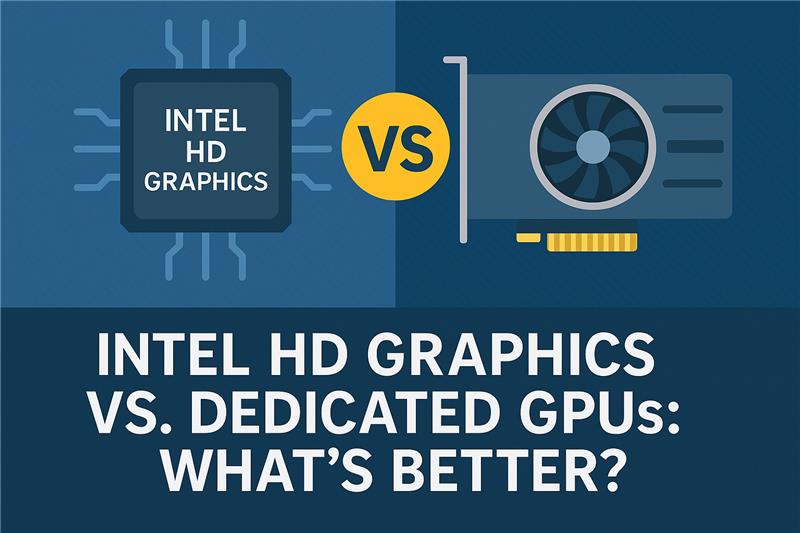

Apr 21, 2025Intel HD Graphics vs. Dedicated GPUs: What’s Better?

Apr 21, 2025StrikeIT: Trusted SEO Company in Lucknow

Apr 21, 2025Why Split & Multi-Split ACs Suit Homes and

Apr 21, 2025Does Botox for Sweaty Gland Block All Sweat?

Apr 21, 2025Best Custom Patches in Malaysia

Apr 21, 20255 Important Health Benefits Of The Shecup Silicone

Apr 21, 2025Part-Time Jobs in Germany for International Students

Apr 21, 2025Affordable Taxi from Blackpool to Manchester Airport

Apr 20, 202570 Inch Bed Frame Maintenance Tips: to Keep

Apr 19, 2025The Beauty of Handmade Shell Jewellery

Apr 19, 2025Exotic Ride Rent A Car in Dubai

Apr 19, 2025WordPress Experts for High-Converting Sites

Apr 19, 2025Key Benefits of Combining Your MOT Test and

Apr 19, 2025Best gold buyers |Sell gold for cash |Hindustan

Apr 19, 2025Statistics Assignment Help – Expert Stats Solutions

Apr 18, 2025Mertra Clothing || Sale Up To 40% Off

Apr 18, 2025Rhinoplasty Cost in Lahore Explained: Find the Right

Apr 18, 2025E-Commerce and Q-Commerce: Compare all Details

Apr 18, 2025Ukraine Premier Vascular Center – Discover AngioLife

Apr 18, 2025Trusted Vascular Solutions in Ukraine

Apr 18, 2025Best Ethernet Cable for Gaming: A Perfect Guide

Apr 18, 2025Sector 140A Noida: A Prime Location for Retail

Apr 18, 2025Unlocking the Power of Ethernet: How It Fuels

Apr 18, 202515 Budget-Friendly Home Remodeling Ideas That Make a

Apr 18, 2025What Should You Know Before Getting Laser Hair

Apr 18, 2025Private Taxi from Birmingham to Manchester Airport

Apr 18, 2025Not Just Pretty – Design a Patio That

Apr 18, 2025Understanding Your CIBIL Score and Its Importance

Apr 18, 2025How Well Does the Intel Arc GPU Perform

Apr 18, 2025Vicdigit Technologies

Apr 18, 2025The Ultimate Guide to Corrugated Boxes

Apr 18, 2025Best Ethernet Cable for Gaming: A Perfect Guide

Apr 17, 2025High-Quality Seat Covers and Mats for Your Car

Apr 17, 2025How to Prepare for Freckles and Blemishes Treatment?

Apr 17, 2025The Top Reasons to Choose Lake Tahoe Boat

Apr 17, 20252031 Industry Report: Key Drivers Fueling the Data

Apr 17, 20259 Scenes Where i7 Laptops Are the Better

Apr 17, 2025Smart Features of Tapmoon Token That You Need

Apr 17, 2025Process Mining Software Market Size to Skyrocket by

Apr 17, 2025Explore a Wide Selection of Smoking Essentials at

Apr 17, 2025Section 125 Tax Savings Plans: What Every Company

Apr 17, 2025Targeted Musculoskeletal Treatment in Edinburgh

Apr 17, 2025How to Layer Skincare with Acne Scar Treatment?

Apr 17, 2025Pizza Novato Is a Must-Try Culinary Experience

Apr 17, 2025How Cloud Solutions in Dubai Are Enabling Remote

Apr 17, 2025How to Get Ready for Your Anti-Aging Facelift

Apr 17, 2025Reliable Solar Panels and Systems for Your Home

Apr 17, 2025Should You Fight for More Disability Benefits and

Apr 17, 2025Modular Office Workstations To Boost Productivity

Apr 17, 2025Find Your Ideal Tech Candidate with EvoTalents

Apr 16, 2025How to Buy a Business in Florida: A

Apr 16, 2025Empowering the Next Generation of Leaders at Lviv

Apr 16, 2025A Vision for the Future of Ukrainian Education

Apr 16, 2025AWS vs. Azure vs. Google Cloud for Hosting

Apr 16, 2025How IV Ozone Helps You Recover Faster from

Apr 16, 2025Why Laundry Services Are Smart for Your Busy

Apr 16, 2025How Hiring an SEO Expert Pays Off for

Apr 16, 2025Decorative LED Lighting for Garden, Backyard & Home

Apr 16, 2025Create Atmosphere with LED Trees & Solar Lights

Apr 16, 2025Comprehensive SEO Services in Dubai: From On-Page to

Apr 16, 2025The Future of Web Design and What It

Apr 16, 2025Transform Your Journey with DNA-Guided Weight Loss

Apr 16, 2025Embrace Wellness at Your Doorstep: The Rise of

Apr 16, 2025Silver Wound Dressing Market Outlook 2031

Apr 16, 2025Immune Checkpoint Inhibitors Market Analysis 2033

Apr 16, 2025Chronic Disease Management Market Disruption

Apr 16, 2025Medical Gas Equipment Market Strategy Guide

Apr 16, 2025How FSM Software Enhances Technician Productivity

Apr 16, 2025Top 5 Online BIM Courses in 2025: Upskill

Apr 16, 2025Gifts for Boyfriend: What Women Are Asking Online?

Apr 16, 2025Top Real Estate Broker Software to Power Smarter

Apr 16, 2025How a Psychiatrist Can Help You Improve Mental

Apr 16, 2025How to Dress Up or Down the Essentials

Apr 15, 2025How to Choose the Best Audio Recorder for

Apr 15, 2025Why Now Is the Best Time to Explore

Apr 15, 2025Global 3D Printing Gases Market Set to Soar

Apr 15, 2025Mitolyn in New York: Ultimate Guide Weight Loss

Apr 15, 2025Top Reasons to Choose a 4-Star Hotel in

Apr 15, 2025Global Nutritional Analysis Market Set to Soar by

Apr 15, 2025How to Use GMB Everywhere? Complete Guide to

Apr 15, 2025From Romantic Getaways to Paint Nights – Gifting

Apr 15, 2025Top Brightening Face Scrubs to Try in 2025

Apr 15, 2025Vibe Experience Gifts – Adventures, Art, Food &

Apr 15, 2025Taking Care Of Health & Beauty at Our

Apr 15, 2025The Future of Healthcare: Why AI Mobile Apps

Apr 15, 2025Does Body Filler Treatment Require Anesthesia?

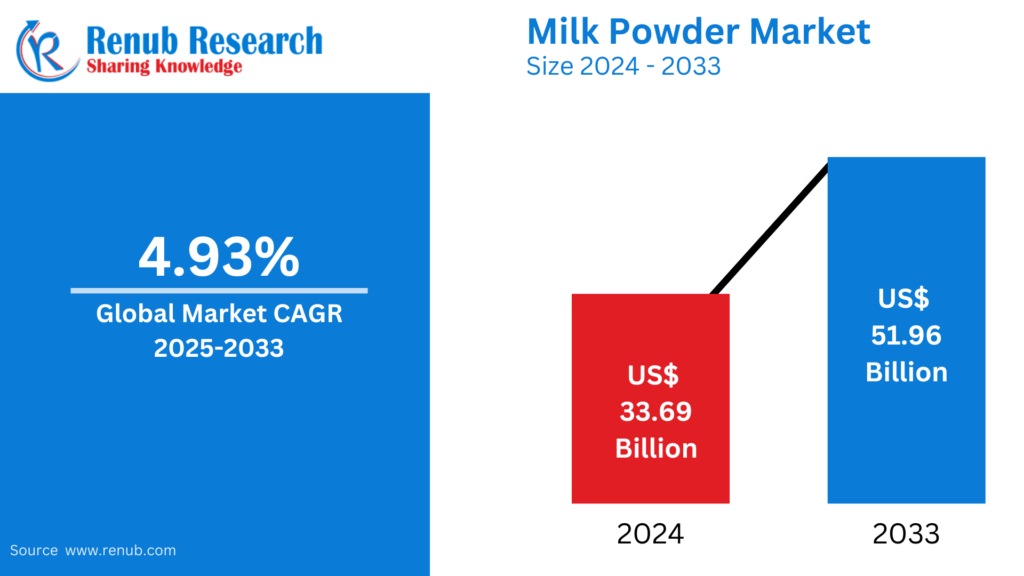

Apr 15, 2025Milk Powder Market : Key Drivers, Regional Insights

Apr 15, 2025Benefits of Choosing a Birthing Center in Tulsa

Apr 15, 2025Dump Trucks & Mining Trucks Market : Key

Apr 15, 2025How the Broken Planet Hoodie Scuplts Distinction

Apr 15, 2025Imported Japanese Diapers & Baby Food at Kurumi

Apr 15, 2025Your Trusted Online Shop for Baby Goods from

Apr 15, 2025Understanding the Role of a Neurologist in Treating

Apr 15, 2025Why You Should Host Your Next Event at

Apr 15, 2025Styling Tips for Korean-Inspired Outfits

Apr 15, 2025Anti-Aging Tips Using Natural Ingredients

Apr 15, 2025How’s the Intel i7 vPro Platform Supporting Remote

Apr 15, 2025Recruitment agency in delhi – hirex

Apr 15, 2025Is Natural Cotton Batting the Best Choice for

Apr 15, 2025Private Taxi from Leeds to Manchester Airport –

Apr 15, 2025Best PPC Company in India for Better ROI

Apr 15, 2025How a Top Video Production Agency is Scooping

Apr 15, 2025B2B Payments in 2025: Emerging Trends and Payment

Apr 15, 2025Navigating Global Trade: How Dubai Became a Shipping

Apr 15, 2025Warren Lotas Hoodie: Exclusive Streetwear

Apr 15, 2025Electric Kick Scooter Market : Insights & Forecast

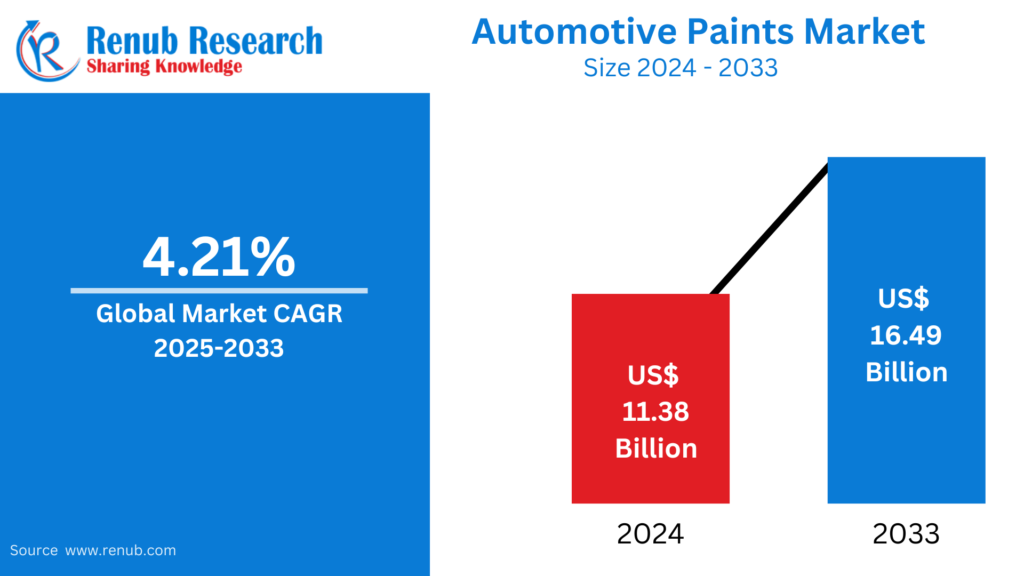

Apr 15, 2025Automotive Paints Market : Insights & Forecast to

Apr 15, 2025Causes of Irregular Periods in Your 30s

Apr 15, 2025Avoiding Common Mistakes When Applying for a Vehicle

Apr 15, 2025Find Premium Home, Beauty, and Health Products at

Apr 15, 2025Shop Quality Products for Every Aspect of Your

Apr 15, 2025Daily Current Affairs in Telugu

Apr 15, 2025Reputable Car Engine Repair: Best Service Practices

Apr 14, 2025MRCOG Part 1 Dates Revealed: What Every Candidate

Apr 14, 2025Is Your Office Lock Jammed? Hire a Locksmith

Apr 14, 2025AZ-104 Exam Dumps: Microsoft Azure Administrator QnA

Apr 14, 2025Why Choosing the Right Audit Company Matters for

Apr 14, 2025Business Travel to Kenya: Visa Rules, Validity, and

Apr 14, 2025Why Spaghetti Strap Blouses Are a Must-Have in

Apr 14, 2025Cheap Taxi from Leeds to Manchester Airport with

Apr 14, 2025The Ultimate Guide to Local SEO for Small

Apr 14, 2025Free 6 Tips: Learn How to Use a

Apr 14, 2025Top Crops for Small-Scale Farming: A Brief Guide

Apr 14, 2025What Are the Key Pieces of Computer Networking

Apr 14, 2025Best Kodi Alternative for iOS in 2025

Apr 14, 2025How do you find the perfect nose shape

Apr 14, 202511 iPhone 12 Case Cover for Nature Lovers

Apr 14, 2025Where to Buy Snore Stop Products Online and

Apr 14, 2025Top Reasons to Choose Thailand for Your Next

Apr 14, 2025Coffee Beans Market is Set to Witness Significant

Apr 14, 2025Snack Food Market is Projected to Reach USD

Apr 14, 2025Vegetable Oil Market to Reach USD 790,878.03 Mn

Apr 14, 2025Abrasive Market Will Achieve USD 63.79 Billion by

Apr 14, 2025Instant wellness? Try home-based IV therapy in Dubai

Apr 14, 2025Are There Programs That Offer Housing Help for

Apr 14, 2025How Noise-Canceling Earbuds Enhance Your Focus

Apr 14, 2025Steps to Purchase from Sp5der Hoodie Brand

Apr 13, 2025MERTRA || Shop Now Mertra Mertra Clothing ||

Apr 13, 2025Understanding Different Types of Teens Counselling

Apr 13, 2025Experience at Hellstar T-Shirt Online Official Store

Apr 13, 2025MERTRA || Shop Now Mertra Mertra Clothing ||

Apr 13, 2025Top 10 Natural Remedies for Insomnia That Help

Apr 13, 2025Where Purpose Meets Action: A Look at Local

Apr 13, 2025How to Find the Right Healthcare Support During

Apr 13, 2025LANVIN® || Lanvin Paris Official Clothing || New

Apr 12, 2025Bape Shirt: Thoughtful Design for Comfort and Style

Apr 12, 2025Ultimate Tips To Boost Your Academic Scores in

Apr 12, 2025The Top 7 Reasons Why Your Car Needs

Apr 12, 2025South Africa Visa Processing Time: What to Expect

Apr 12, 2025Rehydrate, Energize, Glow – All with IV Therapy

Apr 12, 2025Falsely Accused of Domestic Violence? How to Find

Apr 12, 2025Corteiz ® | CRTZRTW Official Website || Sale

Apr 12, 2025Simplify Complex Tasks with MATLAB Assignment Help

Apr 12, 2025Exploring Bare Metal Cloud Market Growth: Trends &

Apr 11, 2025The Ultimate Guide to Quick and Easy Car

Apr 11, 2025Why Use React Helmet for Managing Page Titles

Apr 11, 2025Best Pool Parties in Dubai and Best Beach

Apr 11, 2025Finding the Best Psychologist in Dubai A Guide

Apr 11, 2025Look for Irish Assignment Help Services to Ensure

Apr 11, 2025¿Vale la pena el trasplante de pelo precio?

Apr 11, 2025Tired of Hair Loss? Discover the Magic of

Apr 11, 2025The Importance of Tile Glue and Waterproofing in

Apr 11, 2025Best Therapist in Dubai: Your Guide to Anxiety

Apr 11, 2025Transforming Dubai’s Infrastructure: An Overview

Apr 11, 2025Affordable Stockport Taxis – Book Your Reliable Ride

Apr 11, 2025Handcrafted Eco Baby Toys That Promote Learning |

Apr 11, 2025Saudi Arabia Chiller Market Growth, Key Trends &

Apr 11, 2025Discover Unmatched Comfort at the Best Resorts in

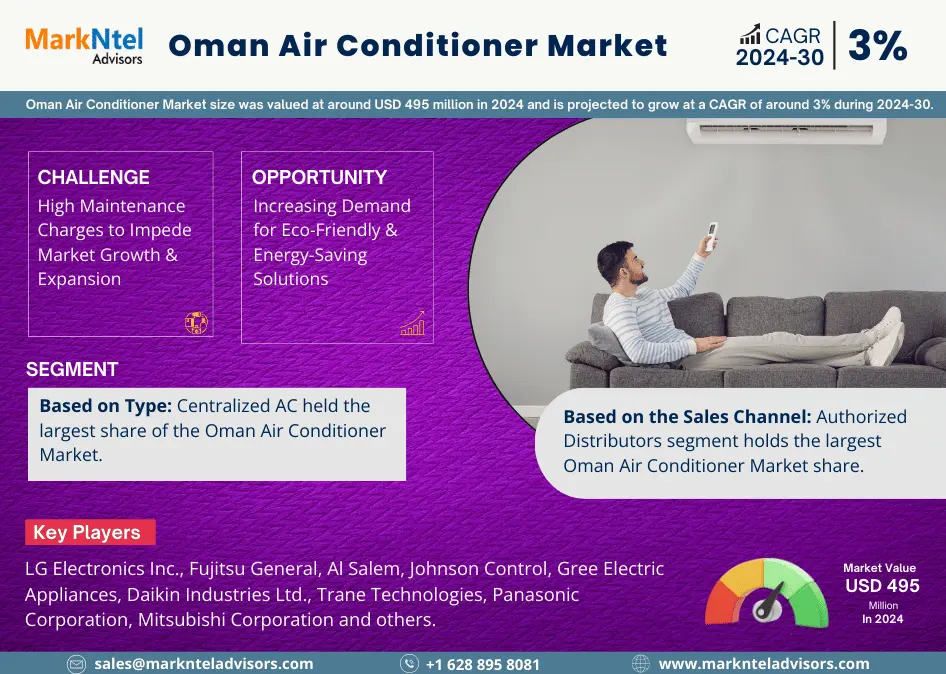

Apr 11, 2025Oman Air Conditioner Market Growth, Key Trends &

Apr 11, 2025Smart Camera Market : Key Drivers, Regional Insights

Apr 11, 2025Middle East and Africa Press Fit Connector Market

Apr 11, 2025Pranav International Oil Mill Machinery

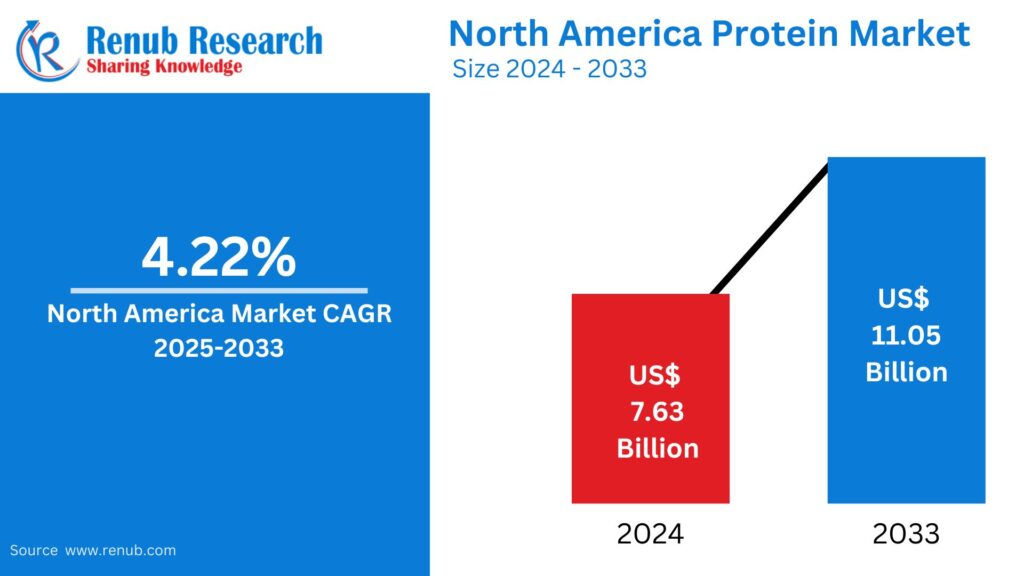

Apr 11, 2025North America Protein Market : Key Drivers, Regional

Apr 11, 2025Do Urinary Tract Infections Lead to Kidney Damage?

Apr 11, 2025Vegan Food Market: Key Drivers, Regional Insights &

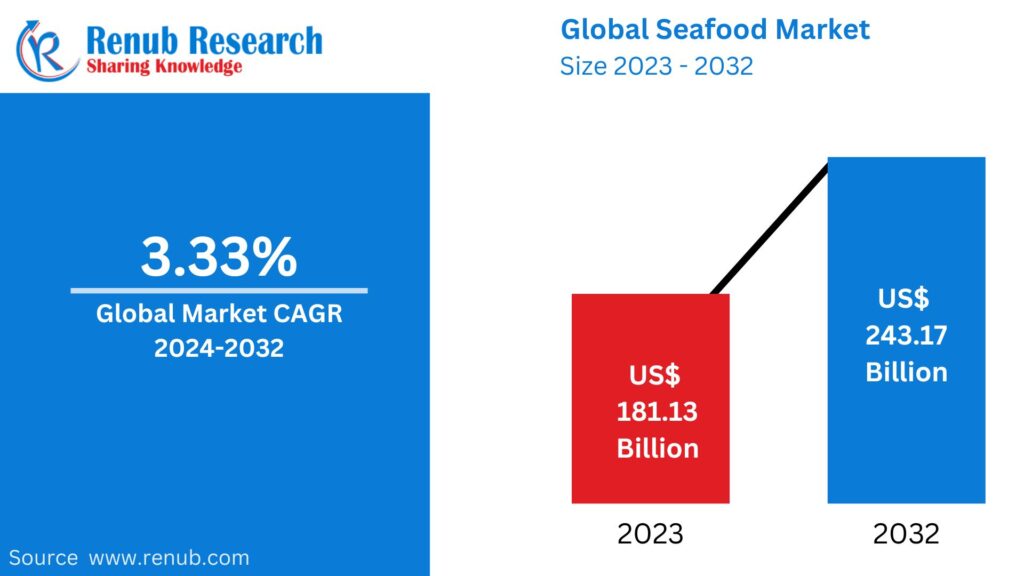

Apr 11, 2025Seafood Market : Key Drivers, Regional Insights &

Apr 11, 2025United States Small Kitchen Appliances Market : Key

Apr 11, 2025Mengapa Ligue 1 Jadi Tambang Emas bagi Pemandu

Apr 11, 2025Cortiez Cargos: The Streetwear Staple You Need in

Apr 11, 2025Google Shopping Feed Simprosys – Sync Inventory Fast

Apr 11, 2025Essentials Shorts: Comfort, Style, and Versatility

Apr 11, 2025Protect London® | Protect LDN Clothing Store |

Apr 11, 2025Protect London® | Protect LDN Clothing Store |

Apr 10, 2025Mertra Uk || MertraMertra Clothing || Online Shop

Apr 10, 2025The Best Guide to Home Security Camera Installation

Apr 10, 2025Evisu Shirt: Thoughtful Design for Comfort and Style

Apr 10, 2025Medical Products for Clinics and Hospitals

Apr 10, 2025Denim Tears Shirt: Thoughtful Design for Comfort and

Apr 10, 2025How Long Does SEO Take to Deliver Results?

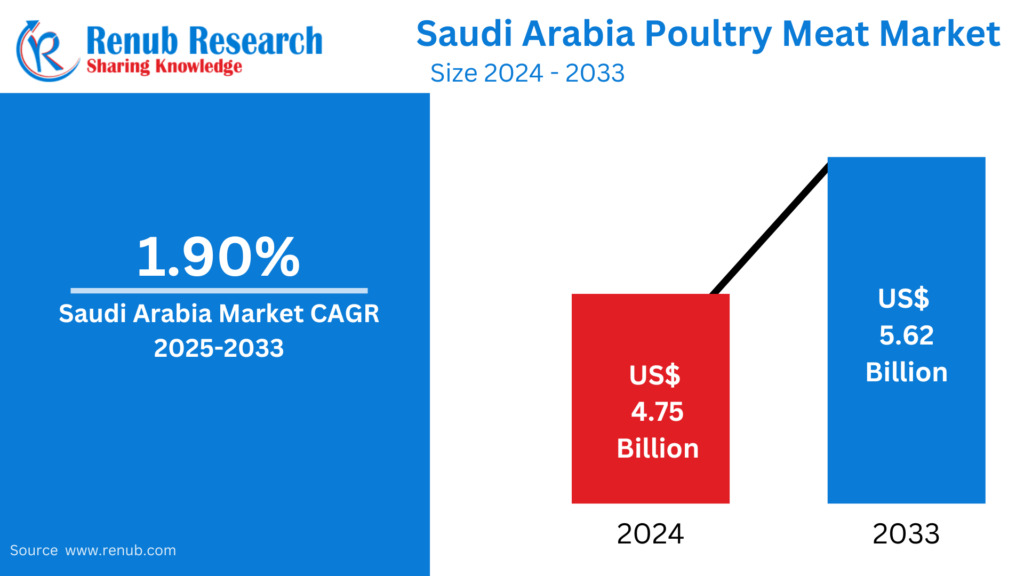

Apr 10, 2025Saudi Arabia Poultry Meat Market : Key Drivers,

Apr 10, 2025Menswear Market : Key Drivers, Regional Insights &

Apr 10, 2025Fire firms help Abu Dhabi businesses meet safety

Apr 10, 2025Child Care and Development: A Guide for Babysitters

Apr 10, 2025The Importance of a Mattress Protector for Your

Apr 10, 2025Car Insurance Dubai: The Importance of Add-ons

Apr 10, 2025Boost Business Safety & Appeal with Outdoor Lighting

Apr 10, 2025SEO Trends for 2025: What’s Changing?

Apr 10, 2025Best Floodlights Guide for Outdoor Spaces in Qatar

Apr 10, 2025Role of a Premier Security Service Company in

Apr 10, 2025The Importance of Timely Concrete Repair in Dubai’s

Apr 10, 2025IV Therapy in Dubai: The Ultimate Solution for

Apr 10, 2025Best Luxury Hotels In Shimla – A Royal

Apr 10, 2025Challenges Faced by Al Ain Contractors & How

Apr 10, 2025Why Investing in a Quality Gaming Chair in

Apr 10, 2025Why Do Events Need an Ambulance On-Site?

Apr 10, 2025How to Create a Cozy Yet Elegant Living

Apr 10, 2025Which Car Insurance is Mandatory in Abu Dhabi?

Apr 10, 2025How to Choose the Perfect Photo Studio for

Apr 10, 2025Male Infertility: Empowering Men to Seek Help and

Apr 10, 2025Commercial Golf Simulator: Cutting-Edge Technology

Apr 10, 2025How Paint Protection Film Saves Money in the

Apr 10, 2025Sleek & Stylish: The Allure of a Modern

Apr 10, 2025The Benefits of Raw Dog Food Diets: Is

Apr 10, 2025How to Manage Type 2 Diabetes Naturally

Apr 10, 2025How to Maintain Artificial Turf in the UAE’s

Apr 10, 2025How Yas Island is Redefining Sustainable Living in

Apr 10, 2025Top Yoga & Wellness Retreats in Dubai to

Apr 10, 2025Shisha & Fine Dining: Top Abu Dhabi Spots

Apr 10, 2025Choosing a Mobile App Developer in Abu Dhabi:

Apr 10, 20252025 Luxury Real Estate Trends: What Buyers Want

Apr 10, 2025Key Factors to Check Before Buying a Dubai

Apr 10, 2025The Hidden ROI of Custom Software: Beyond Just

Apr 10, 2025How Do You Choose the Perfect Gemstones for

Apr 10, 2025Inside TikTok’s Global Hubs: San Jose to Dubai

Apr 10, 2025Can IV Drips Help with Weight Loss?

Apr 10, 2025New Homes for Sale in Salem, Oregon: Affordable

Apr 10, 2025GV GALLERY® || Raspberry Hills Clothing Store ||

Apr 10, 2025Top Natural Wonders to See in Argentina

Apr 10, 2025Why Jacket Designer Are the Unsung Heroes of

Apr 10, 2025Embrace Culture with Stylish Desi T-Shirts

Apr 10, 2025Eco-Friendly Home Renovation Ideas for Chennai Homes

Apr 10, 2025Why Aluminium Doors & Windows Are Perfect for

Apr 10, 2025Do Dham Yatra by Helicopter – A Divine

Apr 10, 2025Transform Your Floors with Our Carpet Cleaner in

Apr 10, 2025Discover the True Cost of Manaslu Circuit Trekking

Apr 10, 2025Men’s Amethyst Bracelet: Bold, Stylish, and Full of

Apr 10, 2025The Best J.League Stadiums for Live Match Experience

Apr 10, 2025Host Nations That Overachieved at the World Cup

Apr 10, 2025Controversial VAR Decisions That Shook Up World Cup

Apr 10, 2025Reaksi Fan Tergila Setelah Gol di Dunia Football

Apr 10, 2025Вашият път към колата от САЩ започва с

Apr 09, 2025Купете автомобил от САЩ лесно и сигурно с

Apr 09, 2025Бързо и безопасно закупуване на автомобил от САЩ

Apr 09, 2025Търгове на автомобили в САЩ – директно до

Apr 09, 2025The Greatest World Cup Matches of All Time

Apr 09, 2025Top Football Nicknames and the Stories Behind Them

Apr 09, 2025Ride Expert-Tested MTB Routes on Fully Guided Tours

Apr 09, 2025Challenging & Scenic MTB Adventures in Europe and

Apr 09, 2025Royal Enfield Bullet 350 With A Ride Through

Apr 09, 2025Unlock Your Future with ACCA Online Courses in

Apr 09, 202510 Reasons to Work with an Email Marketing

Apr 09, 2025How to Match Socks to Your Outfit: A

Apr 09, 2025Recruitment agency in delhi-hirex

Apr 09, 2025Top 10 Trade Show Stand Design Ideas in

Apr 09, 2025Get Funding From Your Investments with a Loan

Apr 09, 2025Furnished Office for Rent in Dubai

Apr 09, 2025Singapore Airlines Bid for Upgrade – How to

Apr 09, 2025Kombiner sport og natur med de bedste MTB

Apr 09, 2025MTB ture i Danmark og Europa – eventyret

Apr 09, 2025The Ultimate Guide to Corteiz: Corteiz Cargos and

Apr 09, 2025Billionaire Boys Club: A Stylish Journey into Luxury

Apr 09, 202510 Questions to Ask Before Hiring a Roofing

Apr 09, 2025Stay Hydrated & Invincible with IV Drip at

Apr 09, 2025Why Kotlin is the Future of Android App

Apr 09, 2025Corporate Health Insurance vs Individual

Apr 09, 2025Insurance Agent Registration: A Step-by-Step Guide

Apr 08, 2025How a Georgetown Mortgage Broker Can Simplify Your

Apr 08, 2025The Mortgage Renewal Process In Calgary: What Should

Apr 08, 2025How Mortgage Brokers in Calgary Can Help You

Apr 08, 2025Human Touch in a Digital World: How Brands

Apr 08, 2025Membranes Market Estimated to Experience a Hike in

Apr 08, 2025How Can Essay Help Improve Grades

Apr 08, 2025Choosing a transparent aligners clinic: What are the

Apr 08, 2025How a Mobile App Development Company Can Boost

Apr 08, 2025Taxi from Manchester to Gatwick Airport – Reliable,

Apr 08, 2025How to choose the best options for industrial

Apr 08, 2025Find Hope and Healing at Our Texas Mental

Apr 08, 2025Cancer Daily Horoscope: Your Cosmic Guide for the

Apr 08, 20259 Reasons IoT is the Future of Mobile

Apr 08, 2025The Origin and Meaning of the Name Cortiez

Apr 08, 2025Reliable Solar Systems for Your Home and Business

Apr 08, 2025signers for sacoche trapstar

Apr 08, 2025How to Find Affordable and Reliable Maid Services

Apr 08, 2025Is Your PC Smarter Than You Think? Meet

Apr 08, 2025Why Every Business Needs a Barcode for Product

Apr 08, 2025Top Skin Clinic in Pune | Dermatologist &

Apr 08, 2025The Benefits Of A Gear Hob Manufacturers

Apr 08, 2025Refinance Mortgage: A Smart Move for Homeowners

Apr 08, 2025Nizoral 2 Percent Guide and Use – Your

Apr 08, 2025Uses of Sports Nets: Essential Gear for Various

Apr 08, 2025Pulled Hamstring Treatment: How to Heal and Recover

Apr 08, 2025Fast & Reliable Local Window Repair Experts

Apr 07, 2025How Virtual Offices in Tulsa Reshape the Future

Apr 07, 2025Choosing the Right SEO Services in Columbus, Ohio

Apr 07, 2025Your Destination for Japanese Beauty Essentials

Apr 07, 2025Tennis Court Cost: What You Should Expect in

Apr 07, 2025Top 7 Home Buying Mistakes to Avoid in

Apr 07, 2025Securing the Cloud: A Deep Dive into VMware

Apr 07, 2025Custom Stairs and Railings by Ora, Featuring Black

Apr 07, 2025The Pros and Cons of a Tankless Water

Apr 07, 2025Natural Yoga Asanas for Hair Growth and Strength

Apr 07, 2025Sovereign Debt & Emerging Markets

Apr 07, 2025The Ultimate Guide to British IPTV: A Smart

Apr 07, 2025Russia Wine Market Trends Forecast 2025-2033

Apr 07, 2025Elevate Your Style with Pakistani Clothes Online –

Apr 07, 2025Gemini Daily Horoscope: Your Guide to the Stars

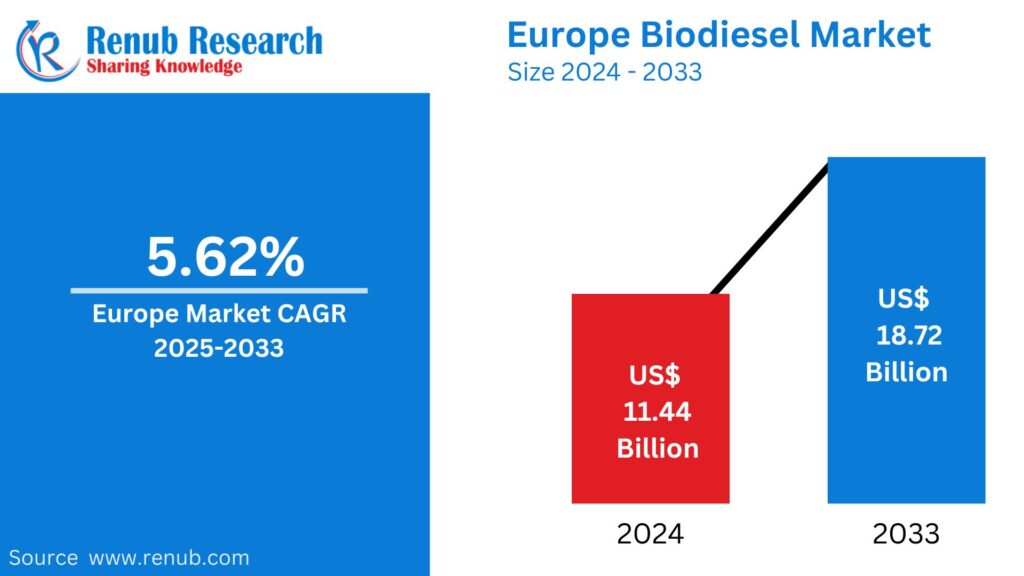

Apr 07, 2025Europe Biodiesel Market Trends Forecast 2025-2033

Apr 07, 20253 Ply Single Wall Custom Corrugated Boxes Supplier

Apr 07, 2025Tissue Paper supplier Everything You Need to Know

Apr 07, 2025United States Soup Market Trends Forecast 2025-2033

Apr 07, 2025The Tactical Evolution of RB Leipzig in 2025:

Apr 07, 2025Top 10 Must-See Bundesliga Goals That Define Modern

Apr 07, 2025Achieve a Flatter, Firmer Abdomen with Tummy Tuck

Apr 06, 2025The Pegador Hoodie OF Urban Fashion

Apr 06, 2025Elevate Your Wardrobe with Vertabrae clothing

Apr 06, 2025What Makes Valabasas Jeans So Popular?

Apr 06, 2025What Makes Essentials Clothing So Popular?

Apr 06, 2025Why syna world tracksuit Is a Perfect Summer

Apr 06, 2025Use the Newest Trends from Madhappy sweatpants to

Apr 06, 2025What Makes corteiz clothing So Popular

Apr 06, 2025How to Get Unlimited Lives in Gardenscapes (2024

Apr 06, 2025The Ultimate Guide to Buying the Perfect Puzzle

Apr 06, 2025The Ultimate List of Prehistoric Combat (2024)

Apr 06, 2025The Mortgage Renewal Process in Courtenay: What You

Apr 06, 2025The Mortgage Renewal Process in saint john-What You

Apr 06, 2025No Surgery, Just Shape—Butt & Body Fillers That

Apr 05, 2025How To Prepare For Management Exams

Apr 05, 2025Septic Tank Service Greeley – Professional Cleaning

Apr 05, 2025Jewellery Business in India – SiriusJewels Franchise

Apr 05, 2025Top Realtors in Johnstown | Buy & Sell

Apr 05, 2025Longmont Solar Installation – Save Big with Solar

Apr 05, 2025Essential Tree Maintenance Tips for a Healthier Yard

Apr 05, 2025Glass Repair Denver | Residential & Commercial Glass

Apr 05, 2025Corteiz Clothing Review – Hype or Reality?

Apr 05, 2025Residential Carpet Cleaning – Keep Home Fresh and

Apr 05, 2025Dead Body Ambulance Services in Delhi: Process, Cost

Apr 05, 2025The Most Trusted IVF Centres in Pitampura for

Apr 05, 2025How to Claim Housing Disrepair Compensation in the

Apr 05, 20251977 Essentials Hoodie The Ultimate Comfort

Apr 05, 2025Box Printing in UAE: Your Ultimate Guide to

Apr 05, 2025How to Get Cheap Flights Last Minute: Top

Apr 04, 2025How to Find the Best Body Massage in

Apr 04, 2025The Offsite EMS Lead Auditor Course: Your Next

Apr 04, 2025Pea Protein Market Size, Report and Forecast |

Apr 04, 2025Step Up Your Sustainability Game with ISO 14001

Apr 04, 2025Stata Assignment Help Tips To Overcome Hurdles In

Apr 04, 2025Mitolyn® | Official Website | 100% Natural &

Apr 04, 2025How to Become a Pro Trader with ICFM’s

Apr 04, 202510 Picturesque Spots in Kilkenny to Visit This

Apr 04, 2025Sell Used iPhone 14 for Cash: Get the

Apr 04, 2025Hire a Professional Packers and Movers Service in

Apr 04, 2025Interior & Exterior House Painters in Adelaide: What

Apr 04, 2025Mertra Uk || MertraMertra Clothing || Online Shop

Apr 03, 2025Florist Doreen: Heartfelt Flower Delivery

Apr 03, 2025MERTRA || Shop Now Mertra Mertra Clothing ||

Apr 03, 2025How Assignment Help in Australia Improves Your Study

Apr 03, 2025Order Funeral Flowers in Cyprus – Fast &

Apr 03, 2025The Role of WeldSaver 5 Passport in Modern

Apr 03, 2025Boris Johnson on Global Shifts at AIM Summit

Apr 03, 2025Personal Loan Interest Rate: Factors That Affect How

Apr 03, 2025Microneedling in Los Angeles: The Secret to Flawless

Apr 03, 2025Society in Central Delhi at The Amaryllis by

Apr 03, 2025Join ICFM Best Stock Market Institute for Traders

Apr 03, 2025Healthy Eating is Within Easy Reach With A

Apr 03, 2025Top Benefits of Choosing Home Delivery Food for

Apr 03, 2025Giorgio Milano’s Commitment to Affordable Luxury

Apr 02, 2025The Ultimate Guide to Booklet Printing: How to

Apr 02, 2025Why Ecommerce App Developers are the Backbone of

Apr 02, 2025How to Fundraise for a Cancer Charity in

Apr 02, 2025Taxi Transfers from Carlisle to Manchester Airport –

Apr 02, 2025The Essential Guide to Lock Pins: Uses, Types,

Apr 02, 2025Stay on Top of Your Billing: The Ultimate

Apr 02, 2025DFD: Your Professional Solution for Mold and Fungi

Apr 02, 2025Dates Market: Size, Share, Growth and Forecast |

Apr 02, 2025Infinity Glow: Lab-Created Diamond Wedding Band

Apr 02, 2025Best Movie Sites Like Fmovies for Streaming Movies

Apr 02, 2025How a Computer Course Can Boost Your Resume

Apr 02, 2025Elevate Your Social Media Presence with GSK SMM

Apr 02, 2025How to Make SMART Financial Choices While Purchasing

Apr 02, 2025Core i5 Laptops in Pakistan: The Ultimate Guide

Apr 02, 2025Ultimate Guide to Picking the Perfect Ergo Office

Apr 02, 2025Ultimate Guide to Choosing the Dog Carrying Purse

Apr 02, 2025The Impact of Backlinks on Ecommerce SEO and

Apr 02, 2025The Growing Demand for Fiber Optics in Kenya’s

Apr 02, 2025Top Things to Do in Machu Picchu for

Apr 02, 2025Triund Trek: A Scenic Adventure in the Heart

Apr 01, 2025TDS on Property Purchase from NRI: Key Rules

Apr 01, 2025How to Choose the Right Two-Wheeler Loan Tenure

Apr 01, 2025How Do I Rank My Real Estate Listings

Apr 01, 2025Tax Saving FD Schemes for Senior Citizens

Apr 01, 2025What is NPS? A Complete Guide to the

Apr 01, 2025Send Stunning Flowers Today | BUKETEXPRESS

Apr 01, 2025What are mutual funds, and how do I

Apr 01, 2025Best Pediatric Oral Dental Clinic Near Me: A

Apr 01, 2025Elementor #17783

Apr 01, 2025A Comprehensive Guide To Using Home Loan Calculator

Apr 01, 2025Private Baby Scans in Edinburgh: Everything You Need

Apr 01, 2025Rock Paper Scissors Yellow Dress Trend Uncovered

Apr 01, 2025How Much Does Air Conditioning Repair in Las

Mar 31, 2025How to Choose the Right Fertility Doctor for

Mar 31, 2025Ukrainian Touch: Precision in Every Translation

Mar 31, 2025Neon Sign: A Timeless Trend in Modern Decor

Mar 31, 2025How to Identify Authentic Free Range Eggs at

Mar 31, 2025TAFE Assignment Help – Get Expert Assistance Today!

Mar 31, 2025How Does SAP S/4 HANA Support Human Resources

Mar 31, 2025Honda City: The Epitome of Style, Comfort, and

Mar 31, 2025Say Goodbye To Mascara – Lash Lounge in

Mar 31, 2025The Ultimate White Fox Hoodie Collection You Can’t

Mar 31, 2025Translation Services in Kyiv – Serving Ukraine for

Mar 30, 202550+ Languages with 750+ Skilled Translators

Mar 30, 2025Cooper Jewelry: Merging Tradition with Modern Styles

Mar 30, 202520+ Years of Trusted Translation Expertise in Kyiv

Mar 30, 2025Tout savoir sur l’abonnement Atlas Pro : Le

Mar 30, 2025Manfredi Jewelry’s 30th Anniversary Celebrations

Mar 30, 2025Benison IVF – The Best IVF Centre for

Mar 30, 2025Cost Analysis of Engagement Platforms

Mar 30, 2025Step Guide to Managing Your Server with OpenVZ

Mar 29, 2025Affordable & Quality Rural Universities in India

Mar 29, 2025Global Market of Shot Blasting Machine Manufacturers

Mar 29, 2025How to File a Small Claims Case in

Mar 29, 2025Shot Blasting Machine Manufacturers in India

Mar 29, 2025best exhibition stand designer in dubai

Mar 29, 2025Bad Friend: The Impact of Toxic Friendships

Mar 29, 2025Syna World Beanie: A Deeper Look into the

Mar 29, 2025Window Cleaning Services: Clarity and Shine for Your

Mar 28, 2025HPE Aruba AP-105: Perfect Wireless Access Point for

Mar 28, 2025Education Loan for Your Higher Studies in India

Mar 28, 2025Certificacion gmp: Why It Matters and How to

Mar 28, 2025Are AI Computers the Next Big Thing in

Mar 28, 2025How AI Computers Make Hiring Smarter and Faster

Mar 28, 2025Why an Insulated Patio Cover is the Best

Mar 28, 2025How Podshop Makes It Easy with a London

Mar 28, 2025The Importance of Using a Torque Wrench Socket

Mar 28, 2025The Future of Mobile Apps: Trends Shaping the

Mar 28, 202510 Must-Have Apps for Your Samsung A34 in

Mar 28, 2025The Science Behind the PSYCH-K® Experience: Fact or

Mar 28, 2025Best Laptops in Pakistan – A Comprehensive Guide

Mar 28, 2025How to Apply for ISO Certification Online: A

Mar 28, 2025ISO 9001 Certification: A Game-Changer for Logistics

Mar 28, 2025Off Plan Villa in Dubai: Hidden Investment Gems

Mar 28, 2025Discover Your Dream Home at Eldeco Trinity

Mar 28, 2025Why ISO Training Should Be Your Next Business

Mar 28, 2025Top 5 M4ufree Alternatives for Movie Streaming in

Mar 28, 2025Exploring Rogue Pouches Flavors: A Flavor for Every

Mar 28, 2025“Up In Flames | Up In Flames London

Mar 28, 2025Best Laptops in Pakistan for Every Need and

Mar 28, 2025“Download Tiranga Game – Experience Ultimate Fun and

Mar 28, 2025The Purrfect Accessory for Your Phone

Mar 28, 2025Warehouse Sizes & Costs in Dubai: A Complete

Mar 28, 20257 Reasons AI Enhances Video Game Development

Mar 28, 2025How to Create a Section 125 Plan Document

Mar 28, 2025Why Cereal Packaging Plays a Bigger Role Than

Mar 28, 2025Best Post Construction Cleaning Services, Omaha

Mar 27, 2025Discover Mussoorie, Rishikesh, and Jim Corbett

Mar 27, 2025Navigating Hair Restoration for Women: Your Path to

Mar 27, 2025Luxury 2-Bedroom Homes for Sale in Jumeirah Park

Mar 27, 2025Get Radiant Skin with Charcoal Scrub-Say Goodbye to

Mar 27, 2025Top Benefits of a Cashew Nut Shelling Machine

Mar 27, 2025Are You Trying to Get Better? Examine the

Mar 27, 2025Which Competencies Are Essential for Jobs as Python

Mar 27, 2025MP3Juice: Free Music Downloads and Fast Access to

Mar 27, 2025Top Hair Transplant Clinics in Delhi Finding the

Mar 27, 2025Why Every Koi Pond Needs a Koi Pond

Mar 27, 2025Boost your vitamin D Levels with this 10

Mar 27, 2025The Power of Planning: Utilising a Personal Loan

Mar 27, 2025The Hidden Advantages: Key Benefits of Investing in

Mar 27, 2025Essential Roofing Tips for Contractors & Homeowners

Mar 27, 2025Your Guide to Roof Replacement Costs in St.

Mar 27, 2025Wholesale Socks for All: Shop in Bulk &

Mar 27, 2025Heavy Duty Caster Wheels India: High Load &

Mar 27, 2025Top 7 Best Mortgage Options Offered By Dream

Mar 27, 2025“Regular Cleaning Services in Jenks, OK | T-Town

Mar 27, 2025Protect London || Protect LDN Official Website ||

Mar 27, 2025IV Therapy for Dehydration: A Fast and Effective

Mar 26, 2025How to Get the Best Couples Massage &

Mar 26, 2025Why is Pharma CRM software necessary for success

Mar 26, 2025Best Algo Trading Software India – Quanttrix Review

Mar 26, 2025Software Entwicklung Agentur Berlin

Mar 26, 2025Best Asthma Doctor in Delhi – Expert Care

Mar 26, 2025UPSC Daily Current Affairs Test Series 2025 by

Mar 26, 2025Benefits of Custom Printed PET Cups & Why

Mar 26, 2025Pet Stomach Endoscopy Cost: 10 Ways to Plan

Mar 26, 2025What’s a Simple and Easy Quilt Pattern for

Mar 26, 2025Conservative Podcasts Worth Listening To

Mar 26, 2025Steps to Select the Right Investors Title Insurance

Mar 26, 2025Bots Now Dominate the Web, and That’s a

Mar 26, 2025Taxi from Glasgow to Manchester Airport Transfer

Mar 26, 2025The Ultimate Guide to Finding the Best Internet

Mar 26, 2025Upgrade Your Equipment with Robust Cast Iron Wheels

Mar 26, 2025How a Rotatable Car Phone Holder Improves Navigation

Mar 26, 2025How to Choose the Best Transport Company in

Mar 26, 2025Work-Life Balance Made Easy: from Laila Russian Spa

Mar 26, 2025The Odoo Support Ecosystem: Beyond the Basics

Mar 26, 2025KBH Games Pokemon Red: A Nostalgic Adventure for

Mar 26, 2025Why Does Krunker Keep Closing? Common Causes and

Mar 26, 202510 Reasons Why Turkey Tour is the Perfect

Mar 26, 2025Choosing thе Right Warеhousе Company in Dubai for

Mar 26, 2025Silk Dress: A Luxury Choice for Modern and

Mar 26, 2025Glass Cabinet Care Tips to Keep It Looking

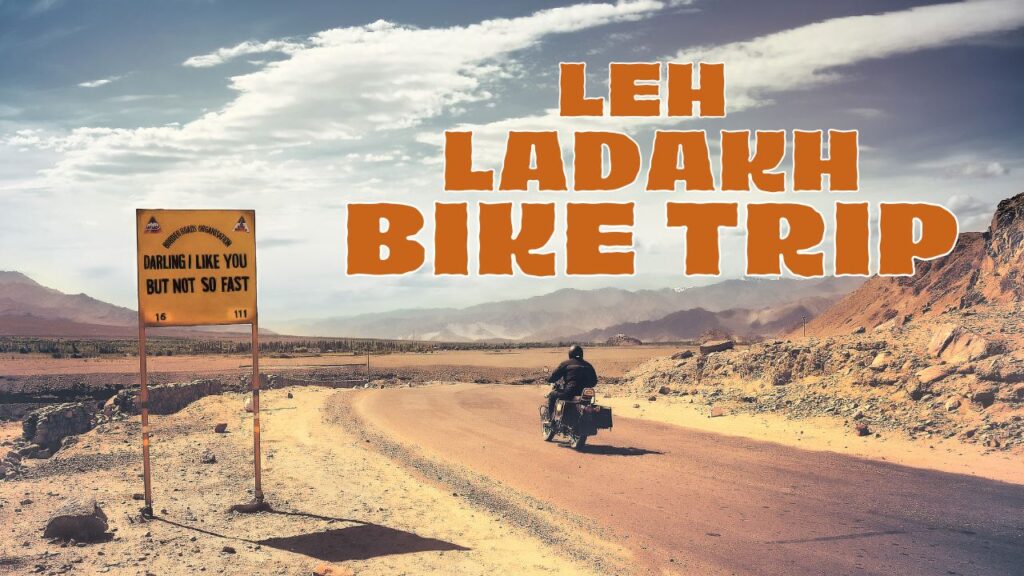

Mar 26, 2025Top 10 Adventure Activities to Try in Leh

Mar 26, 20256 Must-Have Technologies for Modern Gaming Monitors

Mar 26, 2025Test Box Strength with Pacorr’s Compression Tester

Mar 26, 2025Ginny and Georgia Season 3 Plot: Everything You

Mar 26, 2025HP Gaming Laptop: Power and Performance for Gamers

Mar 26, 2025Boost Performance: The Power of a Dedicated Linux

Mar 25, 2025Certification Services in Saudi Arabia

Mar 25, 2025Top 5 Data Analytics Tools for Business Intelligence

Mar 25, 2025Why General Dentistry Is Important for Your Oral

Mar 25, 2025ISO Certification in Pakistan: A Comprehensive Guide

Mar 25, 2025Turning Urban Garden Waste into Green Opportunities

Mar 25, 2025Ace Your Exams with Finance Assignment Help

Mar 25, 2025How to Manage Emergencies During a Leh Ladakh

Mar 25, 2025How to Plan a Scenic Road Trip Through

Mar 25, 2025How to Qualify for a Habitat for Humanity

Mar 25, 2025NAD+ IV Therapy for Hormonal Balance in Dubai

Mar 25, 2025Top 10 Features To Look for in a

Mar 25, 2025Why Penthouses in Qatar Are a Rare Investment

Mar 25, 2025How AI is Changing Recruitment & What Employers

Mar 25, 2025Vinyl vs. Wood Windows: Which is Better for

Mar 25, 2025Make informed decision while choosing to buy best

Mar 25, 2025Choosing the Right Dell 1U Rack Mount Server

Mar 25, 2025Trading on Autopilot: How AI is Reshaping the

Mar 25, 2025Best Multispeciality Hospital in South Delhi

Mar 25, 20256 Reasons to Buy an i5 Gaming Laptop

Mar 25, 2025Download APK Zoom for Laptop – Complete Guide

Mar 25, 2025Boost Your Poetry Career with a Professional Poetry

Mar 25, 2025Choosing the Best Editing Style for Your Athlete

Mar 25, 2025How Intel Arc Works with Intel Core for

Mar 25, 2025Best Massage Therapist in Minneapolis | Relax, Heal

Mar 25, 2025Lightweight vs. Hard-Shell: Which Carry-On is Best?

Mar 25, 2025Gaming Laptops: A Beginner’s Guide to Buying for

Mar 25, 2025What Advantages Do Professional Hair Curlers Offer

Mar 25, 2025Wind Damage on Your Roof? Call a Roofing

Mar 25, 2025The Cost Breakdown of Game Development Services

Mar 25, 2025Saint Vanity | Saint Vanity Shirt || Clothing

Mar 25, 2025Syna World: The UK Streetwear Label Taking Over

Mar 24, 2025Hellstar: The Streetwear Brand Taking Over the Game

Mar 24, 2025Syna World: The Streetwear Empire Shaping UK Fashion

Mar 24, 2025Drama Call: The New Wave of Suspense in

Mar 24, 2025Syna World: The Streetwear Empire Shaping UK Fashion

Mar 24, 2025NOFS: The Game-Changer in Modern Innovation

Mar 24, 2025Syna World: The Streetwear Empire Built by Central

Mar 24, 2025Syna World: The Streetwear Empire Taking Over the

Mar 24, 20255 Common Gym Mistakes & How to Avoid

Mar 24, 2025Everything You Should Know About Dental Implants

Mar 24, 2025Transform Your Business With Expert RPA Consulting

Mar 24, 2025Common challenges in research proposal writing

Mar 24, 2025United States Smart TV Market: Trends, Analysis &

Mar 24, 2025Vegetable Seeds Market : Trends, Analysis & Forecast

Mar 24, 2025Biopsy Devices Market : Trends, Analysis & Forecast

Mar 24, 2025Assessment Help Made Easy: Quality Support for Every

Mar 24, 2025How do you open a savings account online?

Mar 24, 2025United States Ice Cream Market : Trends, Analysis

Mar 24, 2025What Makes a Great Exhibition Stand Builder in

Mar 24, 2025Mexico vs. the U.S.: Why Luxury Homes in

Mar 24, 2025Is the YEEZY GAP Hoodie Worth the Investment or

Mar 24, 2025Discovering the Best Places to Eat in Houston

Mar 24, 2025Exploring Lamb Products: A Culinary Delight

Mar 24, 2025The Psychology Behind Home Visits: Why They Matter

Mar 24, 2025Malaysia Coffee Market : Trends, Analysis & Forecast

Mar 24, 2025Personalized Market By Renub Research