[ad_1]

The industry’s adoption rate has been on an exponential rise, with 64% of consumers now using two or more FinTech services. This widespread adoption is propelling the market toward a projected value of $557 billion by 2030.

As a startup founder, you’re likely aware of the immense potential and rapid growth within the FinTech sector. Notable drivers of this growth include mobile banking, big data, and machine learning, all of which are attracting increasing investment. FinTech is reshaping the financial landscape, leveraging technology to enhance accessibility, security, and efficiency in financial services.

This article is designed to guide you through the intricacies of FinTech app development, a field that’s not only lucrative but also revolutionizing the way we interact with financial services. We will explore various facets of FinTech app development, from understanding its essence and considering investment reasons, to dissecting types of apps and the innovative technologies that fuel them. Lastly, we’ll delve into the financial aspects, discussing development costs and the factors influencing them.

This comprehensive guide aims to equip you with the knowledge and insights needed to navigate the dynamic world of FinTech app development, setting a solid foundation for your entrepreneurial journey in this exciting domain.

What is FinTech app development?

FinTech app development, at its core, is a specialized area of software development that’s focused on creating mobile and web applications that provide financial services. This domain combines the use of software development best practices, methodologies, and technologies to craft applications tailored for the financial sector.

FinTech app development brings various financial operations like banking, investment, and insurance to your fingertips, allowing you to access them via mobile, desktop, or web applications.

The process of developing a FinTech app involves several stages: planning, designing, building, and launching. These applications encompass a blend of software engineering, user experience design, and financial expertise. The goal is to create apps that are not only functional but also user-friendly and meet the specific needs of the users.

For businesses, FinTech app development offers numerous advantages: privacy, attracting new customers, and staying ahead of the curve in the rapidly growing FinTech market. This market is predicted to continue to expand significantly in the coming years.

# Why invest in FinTech app development?

In today’s digital age, investing in FinTech app development is not just a trend, but a strategic business decision. Here’s why:

- Access to cutting-edge technologies: FinTech apps provide businesses with flexible access to advanced technologies like big data, AI, and automation. This technological edge is crucial in staying competitive in a rapidly evolving market.

- Meeting the needs of a digital-first generation: Millennials and Gen Z are digital natives who are increasingly relying on digital solutions. FinTech meets their needs for quick, efficient, and accessible financial services.

- Revenue generation: The FinTech sector is one of the most lucrative in the financial industry, and it’s where the majority of future revenues are expected to be generated.

- Expanding market reach: With FinTech app development, you can reach a broader audience, including a massive number of smartphone users. These apps allow users to perform financial transactions on the go, increasing your business’s reach and potential revenue.

- Enhancing customer experience and loyalty: FinTech apps streamline financial transactions like payments, fund transfers, and balance checks, offering a superior customer experience and fostering loyalty.

- Engagement and sales opportunities: Mobile apps bridge the gap between businesses and users more effectively than websites. They offer a more engaging platform for users, thereby opening new avenues for customer engagement and sales.

- Improved security: Unlike traditional website payments that often have security risks, FinTech apps are equipped with advanced encryption and multiple layers of security, offering safer and faster experiences.

- Efficient data management: In the age where data is king, FinTech apps provide effective data management solutions, thereby improving business productivity and customer experience while reducing operational costs.

- Promoting financial inclusion: FinTech apps are making financial services more accessible, especially to those who haven’t used mobile banking before. They serve as platforms for savings, credit, and other banking services, thus broadening the financial inclusion spectrum.

- Speed and efficiency: FinTech technology enables rapid loan approvals and transaction processing, a speed that traditional banks often cannot match. This efficiency is vital in a fast-paced economic environment.

- User-friendly design: Addressing the complexity and dullness often associated with traditional banking apps, FinTech apps are designed to be more user-friendly, intuitive, and simple to navigate, catering to the user’s need for simplicity and efficiency.

11 FinTech app types with examples

As you delve deeper into the FinTech landscape, understanding the variety of FinTech app types available is crucial. From insurance and investment apps to banking and regulatory technology, the FinTech ecosystem is vast and diverse.

In this section, we’ll explore various FinTech app ideas and types, providing you with a detailed description followed by specific examples for each. This insight will help you identify which FinTech app type aligns with your business goals or personal finance needs.

#1 Loan Apps

Loan apps have transformed the lending landscape by facilitating direct connections between lenders and borrowers, streamlining everything from applications to repayments.

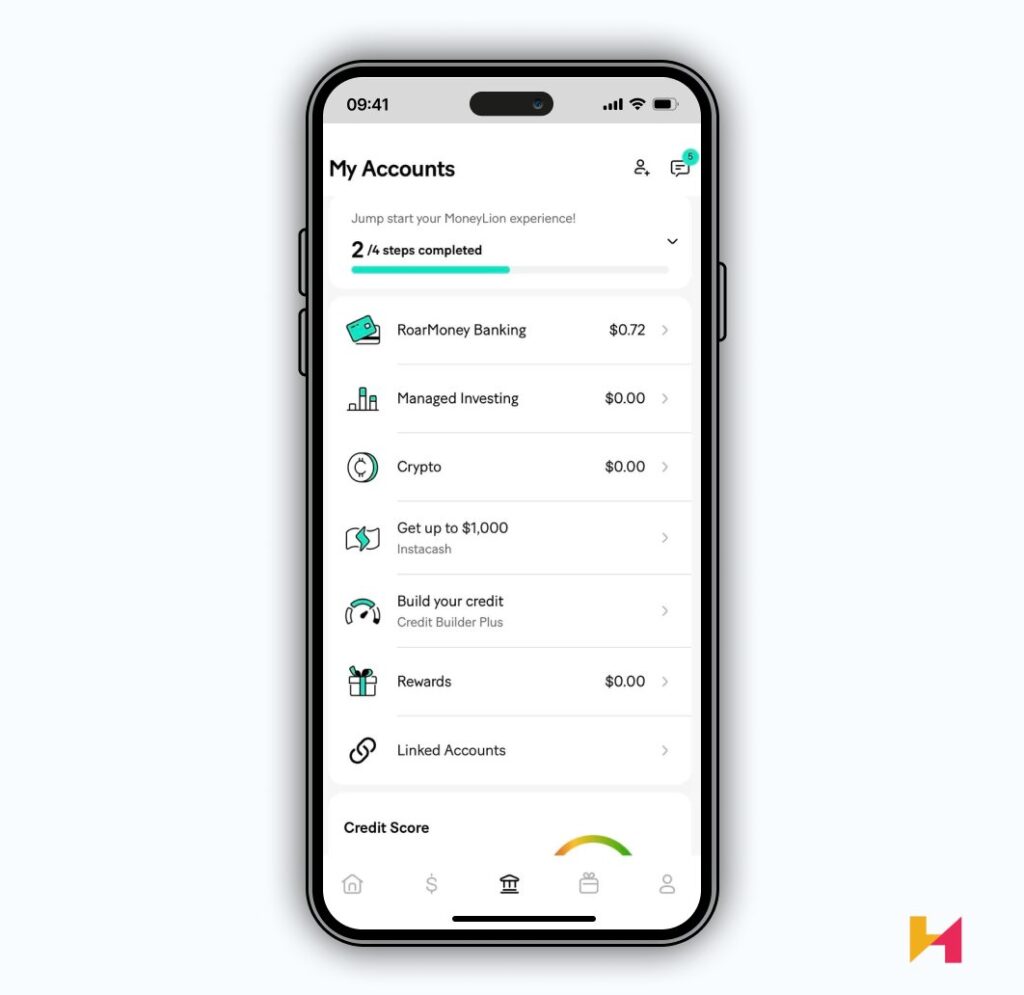

Example: MoneyLion

MoneyLion stands out in this space with features like no-fee checking accounts, managed investing, cashback rewards, and credit builder loans. It’s a comprehensive financial app that combines lending with personal finance management.

#2 Digital Banking Apps

Digital banking apps are reshaping how we bank, providing services like account management and funds transfer without the need for physical branches.

Example: Chase Mobile

The Chase Mobile app allows users to monitor their account balances, pay bills, deposit checks remotely, and even locate ATMs or branches nearby. It’s a complete banking solution in your pocket.

#3 Insurance (Insurtech) Apps

Insurtech apps have modernized the insurance industry, offering streamlined risk assessments and faster claims processing.

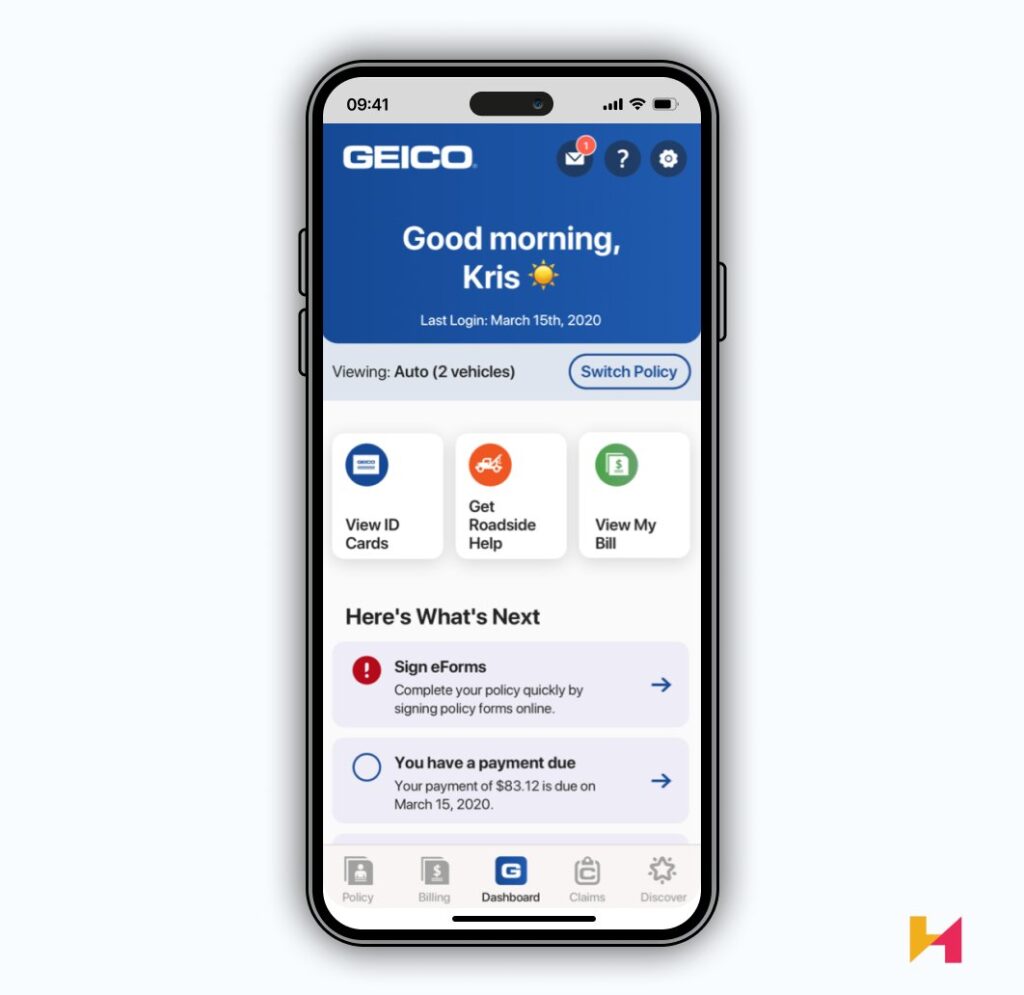

Example: Geico Mobile

Geico Mobile app simplifies managing insurance policies, from viewing coverage details to filing claims and accessing digital ID cards. Its intuitive design enhances user experience in insurance management.

#4 Investment Apps/Wealthtech

Investment apps democratize access to the stock market, backed by features like robo-advisors and AI-driven portfolio management.

Example: Robinhood

Robinhood, renowned for its commission-free trades, offers an easy-to-use platform for trading stocks, ETFs, and cryptocurrencies. It also provides financial news updates and market data to help users make informed decisions.

Founders tend to underestimate the complexity of FinTech app development, especially when it comes to integrating advanced technologies such as AI and blockchain. FinTech development must be approached with a balance of innovation and regulatory compliance, as overlooking the latter can lead to significant setbacks. Our role is to ensure that while our clients strive for technological sophistication, they also maintain an unwavering focus on user security, regulatory frameworks, and a deeply intuitive user experience.

CEO, ASPER BROTHERS

Let’s Talk

#5 Payment Processing Apps

These apps streamline digital transactions, serving as a bridge between credit card companies and customers, crucial for e-commerce and online services.

Example: PayPal

PayPal offers secure and quick payment solutions for both personal and business transactions. It features options like sending money, requesting payments, and creating invoices, making digital payments effortless.

#6 Personal Finance Management Apps

These apps centralize financial information, offering tools for budgeting, tracking expenses, and financial planning.

Example: Mint

Mint provides a comprehensive overview of your finances by linking to your bank accounts, tracking your spending, categorizing expenses, and even offering budgeting advice based on your financial habits.

#7 Tax Filing and Management Apps

Tax management apps simplify and automate the process of filing taxes, ensuring compliance and reducing errors.

Example: TurboTax

TurboTax is known for its user-friendly interface, offering guided tax filing, deduction discovery, and real-time tax refund calculations. It also provides expert advice for complex tax situations.

#8 Neobanks

Neobanks offer online-only financial services, often with lower fees and innovative features compared to traditional banks.

Example: Chime

Chime offers services like fee-free overdrafts, early direct deposits, and automatic savings features. It’s tailored for a seamless digital banking experience with real-time transaction notifications and daily balance updates.

#9 Buying or Renting Apps

These apps provide flexible payment plans for purchases, catering to the modern consumer’s desire for financial flexibility.

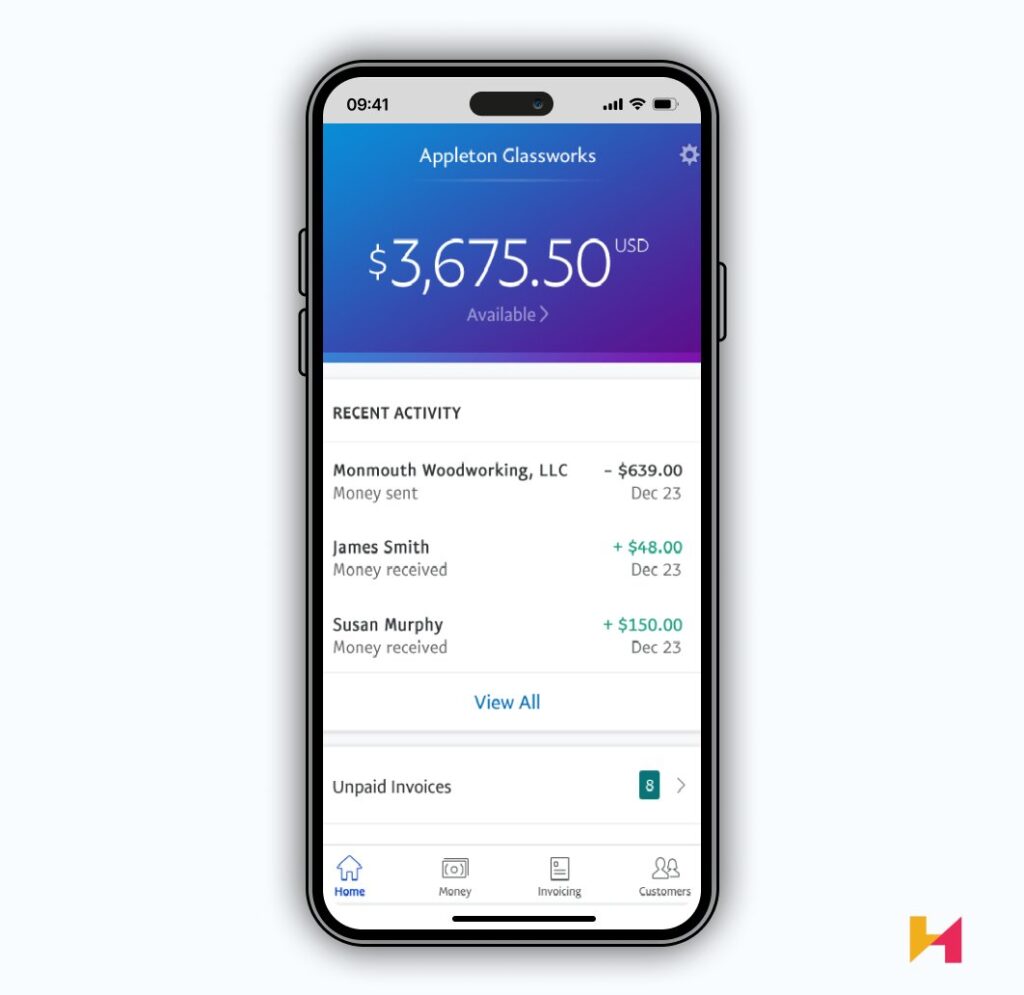

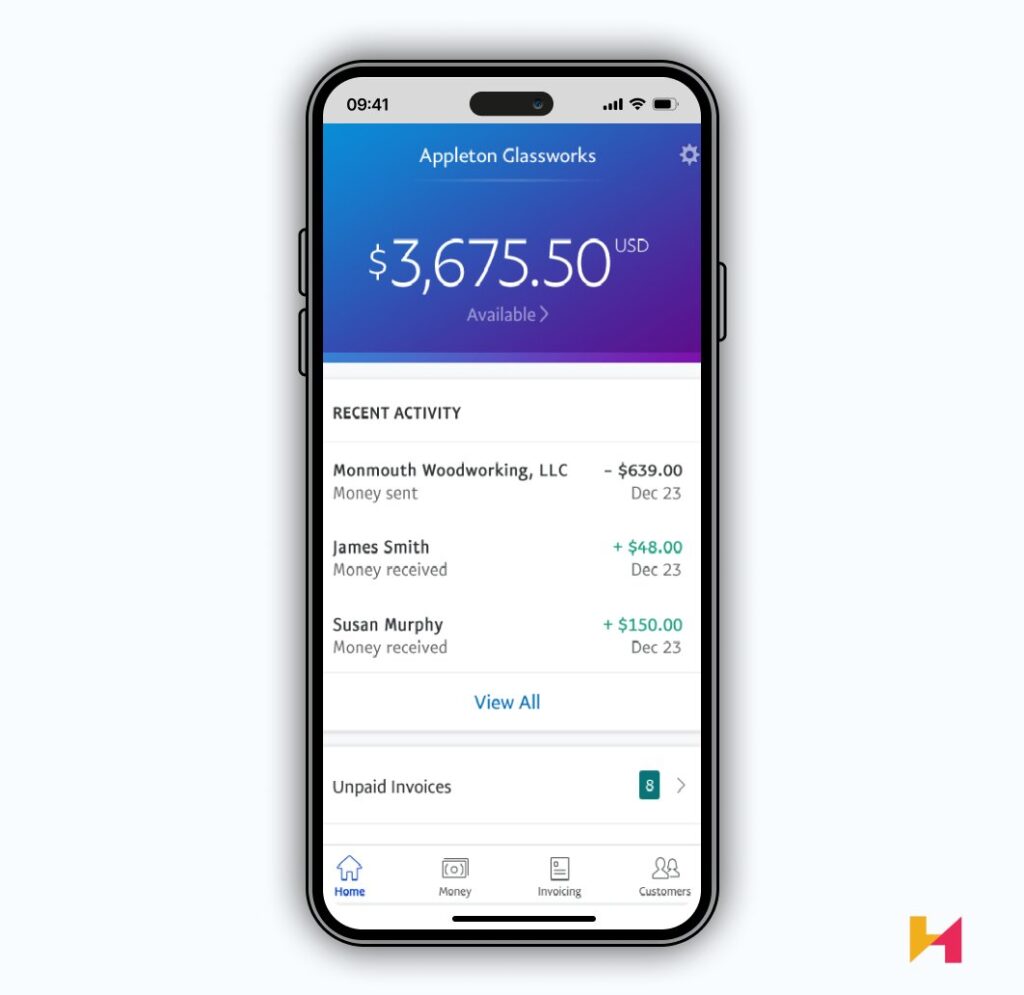

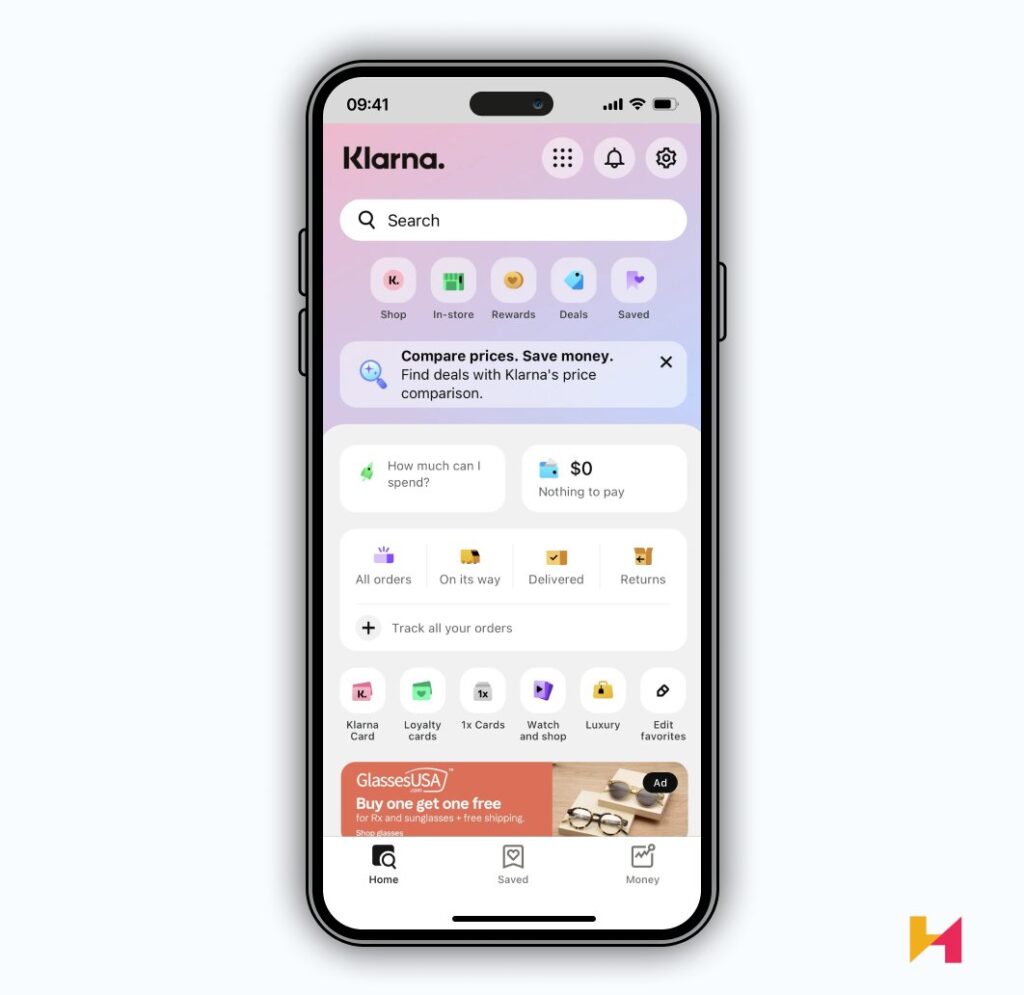

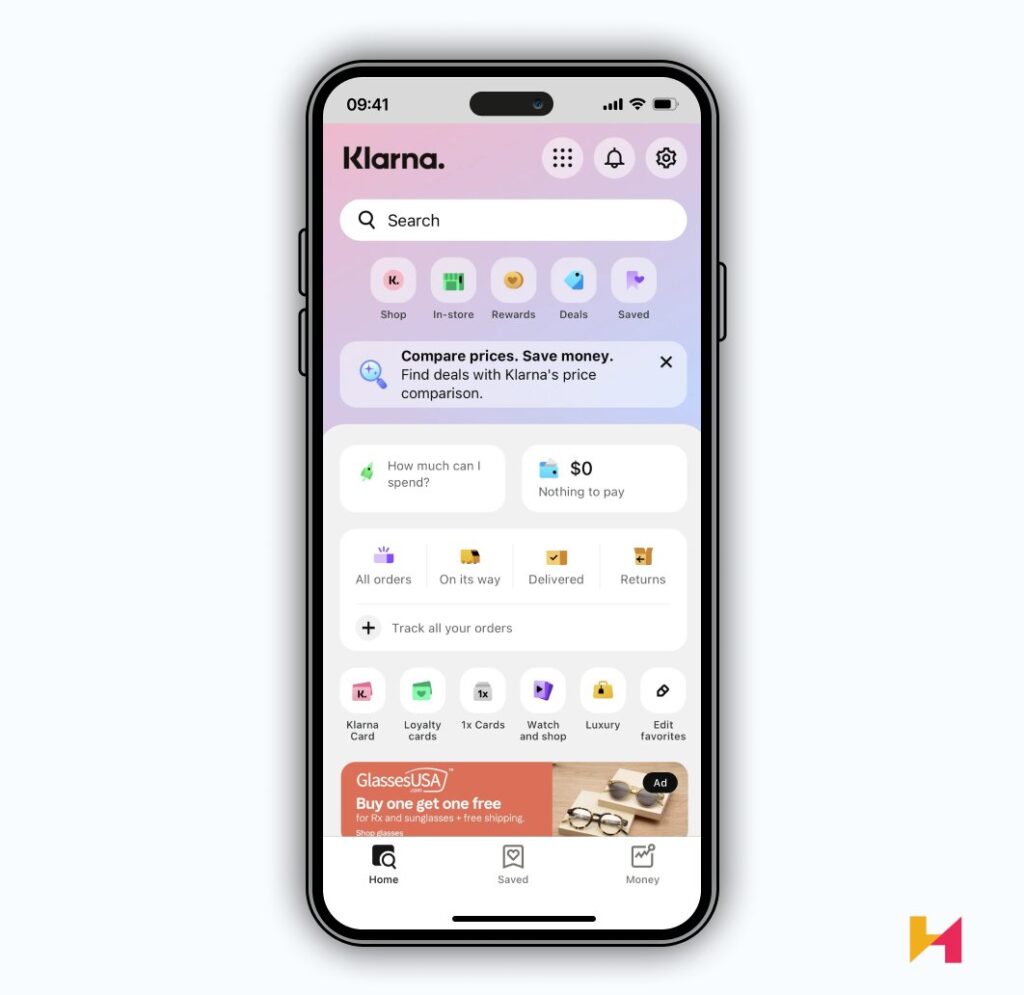

Example: Klarna

Klarna offers several payment options, including ‘Pay in 4’, where users can split their purchases into four interest-free installments. It also provides a seamless shopping experience with features like price drop notifications and wish lists.

#10 Consumer Finance Apps

Consumer finance apps cater to daily financial needs, offering budgeting tools, financial advice, and credit monitoring.

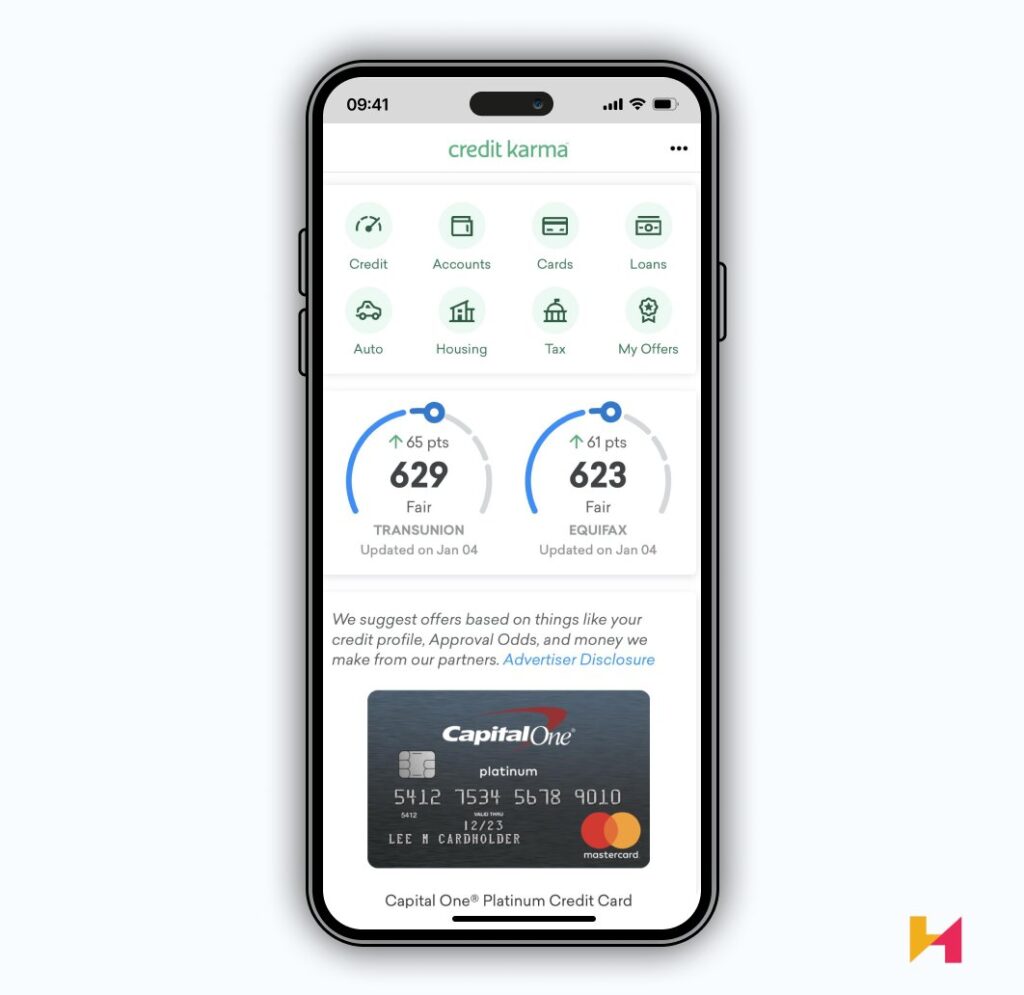

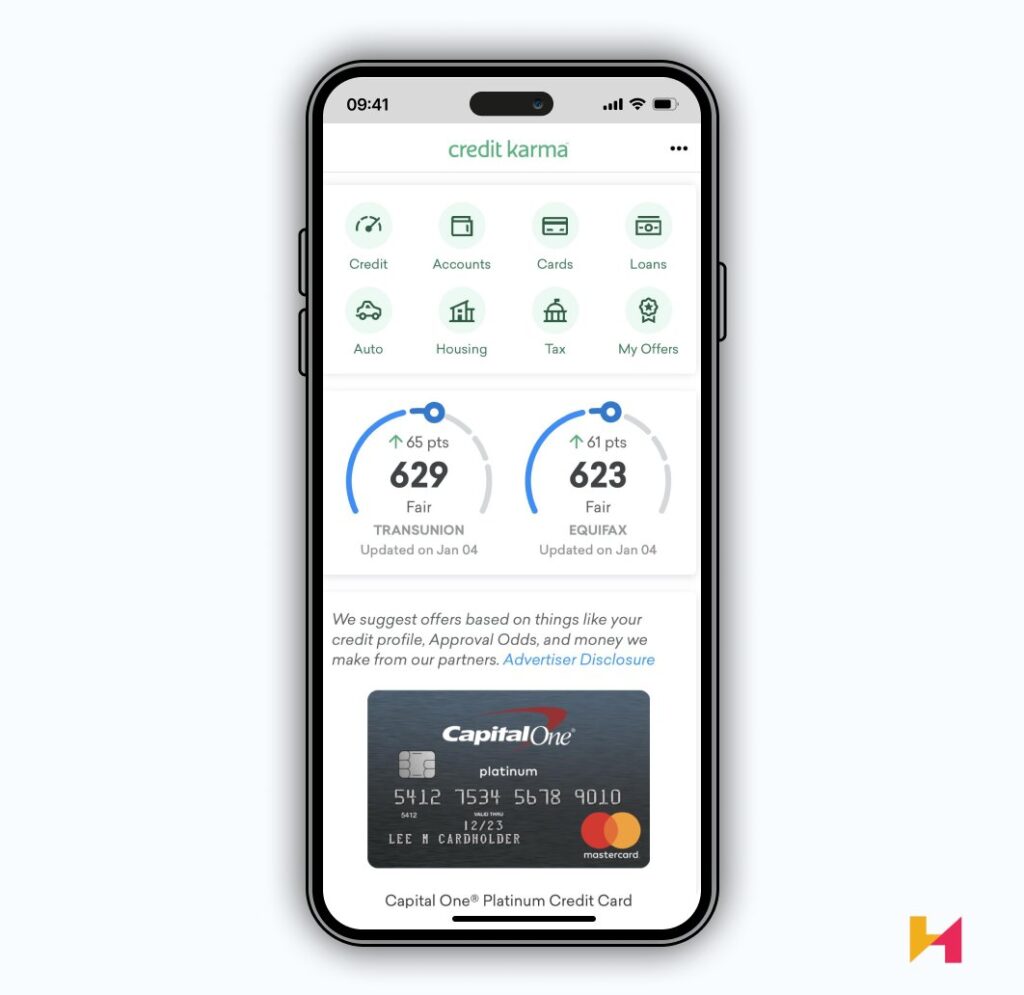

Example: Credit Karma

Credit Karma focuses on credit score management and offers personalized loan and credit card recommendations. It also provides insights into factors affecting your credit score and suggests ways to improve it.

#11 Lending Apps

Focused on providing short-term loans or payday advances, these apps offer quick financial solutions with minimal hassle.

Example: Brigit

Brigit provides cash advances up to a certain limit, alerts to prevent overdrafts, and even offers financial advice. It’s a tool for managing personal finances and avoiding bank overdraft fees.

Innovative technologies & features to implement in a FinTech app

In this section, we will explore a range of innovative technologies and features that are transforming FinTech apps, making them more secure, efficient, and user-friendly. From advanced security measures to AI-powered tools, these innovations are not just shaping the current landscape of FinTech, but also paving the way for its future.

Let’s dive into the specific technologies and features that are making a mark in the FinTech app development industry:

- Security with multitier authentication: Security is paramount in FinTech apps due to the sensitive nature of financial data. Implementing advanced security practices such as blockchain, biometrics, encryption, and two-factor authentication is crucial. These measures ensure that user data remains confidential and secure, thereby building user confidence in the app.

- Payments integration: Integrating robust payment gateways like PayPal and Stripe is essential for FinTech apps, especially those revolving around payment transactions. This integration offers users a seamless and secure platform for managing savings and spending.

- Machine Learning: Machine learning (ML) is revolutionizing FinTech apps by enabling personalized financial advice based on user activity and habits. ML algorithms analyze data from various inputs to tailor advice, enhancing user experience and financial management efficiency.

- Dashboards: Providing intuitive dashboards in FinTech apps helps users better understand their financial habits. These dashboards visually represent spending, payment history, and investment portfolios, aiding in informed decision-making.

- Voice integration: Voice integration, through tools like Alexa and Siri, allows users to interact with FinTech apps conveniently. This feature enhances user experience by enabling app interaction without the need for manual navigation.

- Blockchain: Blockchain technology in FinTech apps enhances security and transparency. It enables secure, decentralized finance, eliminating the need for intermediaries in transactions and financial management.

- AI-powered recommendations: AI-driven features like personalized financial advice, fraud detection, and conversational support are transforming FinTech apps. These features create more user-friendly processes and contribute to better financial decision-making.

- Chatbots: AI-powered chatbots in FinTech apps offer 24/7 customer support, solving minor consumer issues and guiding new users. They increase productivity and improve the user experience.

- Alerts and notifications: Implementing alerts and notifications in FinTech apps keeps users informed about important account activities and market changes, enhancing user engagement and financial awareness.

- Big Data and analytics: Integrating big data and analytics in FinTech apps allows for the processing and interpreting of vast amounts of financial data. This aids in making more accurate predictions and financial decisions.

- Robo-advising and stock trading: Robo-advisors in FinTech apps automate investment management, using AI and machine learning to manage portfolios and make trades based on user profiles and market conditions.

- Biometrics: Biometric authentication methods, like facial recognition and fingerprint scanning, are becoming increasingly common in FinTech apps. They provide enhanced security and user verification, making unauthorized access nearly impossible.

- Gamification: Incorporating gamification elements can make FinTech apps more engaging and enjoyable, encouraging user participation and enhancing the overall experience.

- Robotic Process Automation (RPA): RPA uses verified data and logic to increase the efficiency of financial reporting, risk assessment, and auditing. This automation accelerates processes and improves decision-making accuracy in FinTech apps.

- Open banking: Open banking APIs allow FinTech apps to provide value-added services, making financial services more interconnected and accessible to users.

- Decentralized finance (DeFi): The growth of DeFi in FinTech apps aims to provide financial services without intermediaries, leveraging blockchain technology for secure and transparent transactions.

- Microservices: Microservices architecture simplifies FinTech app development, accelerates deployment, and enhances efficiency. This technology allows FinTech services to be more responsive to changes, ensuring a user-friendly experience.

- Mobile banking and P2P loans: Mobile banking and P2P loan lending are integral to FinTech apps, providing users with quick and easy access to financial services like credit card applications, money transfers, and investments.

FinTech app development cost

Developing a FinTech app is a significant investment, both in terms of time and money. Understanding the costs involved is crucial for anyone looking to enter this space. In this section, we’ll explore the various aspects that contribute to the cost of FinTech app development. We’ll provide a broad range of costs and delve into specific factors that influence these costs, such as the features included, the number of platforms targeted, and the technology used.

First, let’s look at the general FinTech app development cost, followed by a detailed examination of the factors that can affect this cost.

# Cost range

Developing a FinTech app involves various expenses, and the cost can significantly vary based on several factors.

On average, FinTech app development costs can range from $50,000 to as high as $500,000 or more.

This wide range is due to the diversity of features, complexity, and other variables inherent in app development.

# Factors influencing FinTech app development cost

Several critical factors influence the cost of developing a FinTech app:

- App complexity: The intricacy of the app, including features, complexity, third-party integrations, and the overall scope of work, directly affects the development costs. More comprehensive and complex feature sets lead to greater development efforts and higher costs.

- Platform: The choice of platform (iOS, Android, Web, or multiple platforms) also impacts the cost. Building for multiple platforms incurs additional expenses.

- Design: The design of the app, balancing aesthetics and functionality, influences development costs. A sophisticated design requires more effort and skilled UI/UX professionals.

- Location and structure of the development team: Labor costs vary depending on the geographical location of the development team and whether the team comprises freelancers, an in-house team, or an agency.

- Maintenance and updates: Ongoing maintenance and updates post-launch are essential for keeping the app relevant and functional, contributing to the long-term cost of app ownership.

- Regulatory compliance: FinTech apps operate in a highly regulated environment, and ensuring compliance with financial regulations adds complexity and cost to the development process.

- Technologies: The integration of advanced technologies like digital analytics, blockchain, and artificial intelligence significantly impacts development costs. More sophisticated features require advanced technology and expertise.

- Tools and languages: The technological stack, including the programming languages and tools chosen for the project, affects costs. Native, cross-platform, and hybrid applications each have specific technology stacks and associated costs.

It’s important to note that higher costs do not guarantee success. Focusing on user experience and meeting the needs of the target audience is crucial for the app’s success.

Conclusion

As the FinTech industry continues to evolve at a rapid pace, its future seems promising and ripe with potential. The integration of cutting-edge technologies such as AI, blockchain, and machine learning is set to further revolutionize the way we interact with financial services. The increasing investment in this sector underscores its potential for growth and innovation.

With the continued emergence of new players and technologies, the FinTech landscape is poised to deliver more personalized, secure, and efficient financial solutions that will have a profound impact on both businesses and consumers. Without a doubt, FinTech is poised to reshape the financial world for a more inclusive and accessible future.

[ad_2]

Source link